Resources

All the latest insights, news and resources

From topical webinars to helpful guides and templates, we are constantly producing up-to-date, relevant materials to help employers manage their workforce and safety responsibilities.

Free webinar | 18 April, 2.00 pm

Employment Law Update | April changes and what lies ahead

2024 is shaping up to be a busy year for employment law.

From holiday pay to TUPE, protections for pregnant mothers to flexible working, a raft of new regulations are on their way – and some have already been brought into force at the start of the year.

To help you digest these developments and understand how they might impact your policies, procedures and staff training, our employment law experts are returning for another free one-hour webinar, where they will walk you through what’s new, what’s just around the corner, and what’s still to come.

Free webinar | Available now

Workplace Incidents | prevention, investigation and post-accident protocols

Free webinar | Available now

Disciplinaries and Investigations | when is action warranted?

Personalise your content

Type

All

Blogs

Brochures & Factsheets

COVID-19

Events

Guides

News

Templates

Testimonials

Videos

Webinars

Whitepapers

Category

All

Employment Law Resources

Health & Safety Resources

HSE continues to expand its asbestos campaign

Blog16 Apr 2024

Guide to Workplace Health and Safety Incidents

Guide12 Apr 2024

Leveraging the candidate journey to maximise recruitment success

Blog10 Apr 2024

Guide to Employee Wellbeing and Management Under the CQC's New Framework

Guide04 Apr 2024

Managing employees suspected or convicted of criminal offences

Blog20 Mar 2024

Employment Facts & Figures Reference Guide 2024/25

Guide20 Mar 2024

Unveiling Key Insights | the dynamic partnership between HR professionals and line managers in employee relations.

Webinar 29 Feb 2024

CQC's New Framework| interpreting employee wellbeing and management statements

Webinar29 Feb 2024

CQC Policy Creation Factsheet

Factsheet28 Feb 2024

CQC Registrations Factsheet

Factsheet28 Feb 2024

CQC Mock Inspections Factsheet

Factsheet28 Feb 2024

CQC Compliance Support Factsheet

Factsheet28 Feb 2024

Avoiding discrimination | The impact of a rising State Pension age on PHI schemes

Blog28 Feb 2024

Exploring recruitment trends in 2024 | What’s changing in the hiring landscape?

Blog27 Feb 2024

Flexible working | Acas survey reveals homeworking continues to rise ahead of April changes

Blog22 Feb 2024

Guide to Disciplinaries and Investigations

Guide22 Feb 2024

The Modern Way of Training | The importance of a blended approach

Whitepaper20 Feb 2024

Holiday Rights Detailed Reference Guide for Education Providers

Guide15 Feb 2024

Future-Ready Safety Guide

Guide14 Feb 2024

Future-proofing independent schools | Increased TPS costs and changing teachers’ contracts

Blog13 Feb 2024

Supporting employees during Ramadan

Blog12 Feb 2024

Reforms to holiday rights | 7 important updates for schools

Blog31 Jan 2024

Personal Relationships at Work Policy

Template29 Jan 2024

Holiday Rights Detailed Reference Guide

Guide25 Jan 2024

Holiday Rights Quick Reference Guide

Guide25 Jan 2024

Crafting compelling and inclusive job adverts | 5 top tips

Blog25 Jan 2024

Immediate Changes to Holiday Pay Legislation for Schools

Webinar25 Jan 2024

Workplace stress | Why employers should put mental health front and centre in 2024

Blog24 Jan 2024

WorkNest survey unearths mounting delays in disciplinary processes – with most cases now taking 1 month or more to complete

Blog23 Jan 2024

Workplace transport risk assessments | 7 tips for separating vehicles and pedestrians

Blog22 Jan 2024

Noise at work | The SHOUT test!

Blog22 Jan 2024

WorkNest Welcomes New Year with Female Duo at the Helm of Legal Services

News18 Jan 2024

Hybrid work | Re-establishing expectations around office attendance in 2024

Blog15 Jan 2024

Guide to Employment Law Changes 2024

Guide02 Jan 2024

Fire Safety Legislation Changes - Guidance for Non-Residential Premises

Guide15 Dec 2023

Fire Safety Legislation Changes - Guidance for Residential Premises

Guide15 Dec 2023

Resolving Workplace Conflict Flowchart

Guide07 Dec 2023

Employment Law Update | what’s coming in 2024

Webinar30 Nov 2023

Guide to Preparing for the CQC's New Single Assessment Framework

Guide29 Nov 2023

Holiday Pay 101

Guide27 Nov 2023

Employing ex-offenders | Changes to disclosure periods for criminal convictions in England and Wales

Blog27 Nov 2023

End-of-year recruitment | Should you hold off hiring until after the holidays?

Blog24 Nov 2023

HSE statistics 2023 show slow to no progress in driving down work-related injuries and ill health

Blog22 Nov 2023

WorkNest People and Management Training Brochure

Brochure

Maintaining compliance | The crucial role of mock inspections in the care sector

Blog17 Nov 23

CQC evidence categories | New assessment framework update

Blog17 Nov 2023

7. SafetyNest Bitesize Video - Template Admin

Interpreting the CQC’s New Framework | what you need to know

Webinar15 Nov 2023

Quiet firing | Why silence isn’t golden when it comes to employee management

Blog13 Nov 2023

Christmas Party Memo

Template09 Nov 2023

Guide to Workplace Conflict

Guide06 Nov 2023

How to safely dismiss short-service staff

Blog01 Nov 2023

Recruitment | 5 top tips for more effective interviewing

Blog31 Oct 2023

Reluctant Returners Guide

Guide25 Oct 2023

Guide to Supporting Neurodiversity in the Workplace

Guide24 Oct 2023

LearningNest eLearning Essentials Factsheet

Factsheet

LearningNest eLearning Premier Factsheet

Factsheet

LearningNest eLearning Enterprise Factsheet

Factsheet

LearningNest eLearning Enterprise Brochure

Brochure

LearningNest eLearning Essentials Brochure

Brochure

LearningNest eLearning Premier Brochure

Brochure

Alcohol at work events | How to prevent 3 sobering HR problems this party season

Blog23 Oct 2023

CIPD Annual Conference and Exhibition 2023

Resolving Workplace Conflict | strategies for intervention and prevention

Webinar19 Oct 2023

CaseNest Client Demonstration

Supreme Court overturns ‘three month break’ rule in holiday pay claims

Blog13 Oct 2023

Workplace conflict accounts for nearly half of all grievances, according to WorkNest survey

Blog09 Oct 2023

Catholic Blind Institute

Customer Story - PDF

5 key recruitment trends that could help combat staff shortages in the charity sector

Blog05 Oct 2023

Refusals to Work Guide

Guide04 Oct 2023

New legislation grants UK workers the right to request more stable work schedules

Blog02 Oct 2023

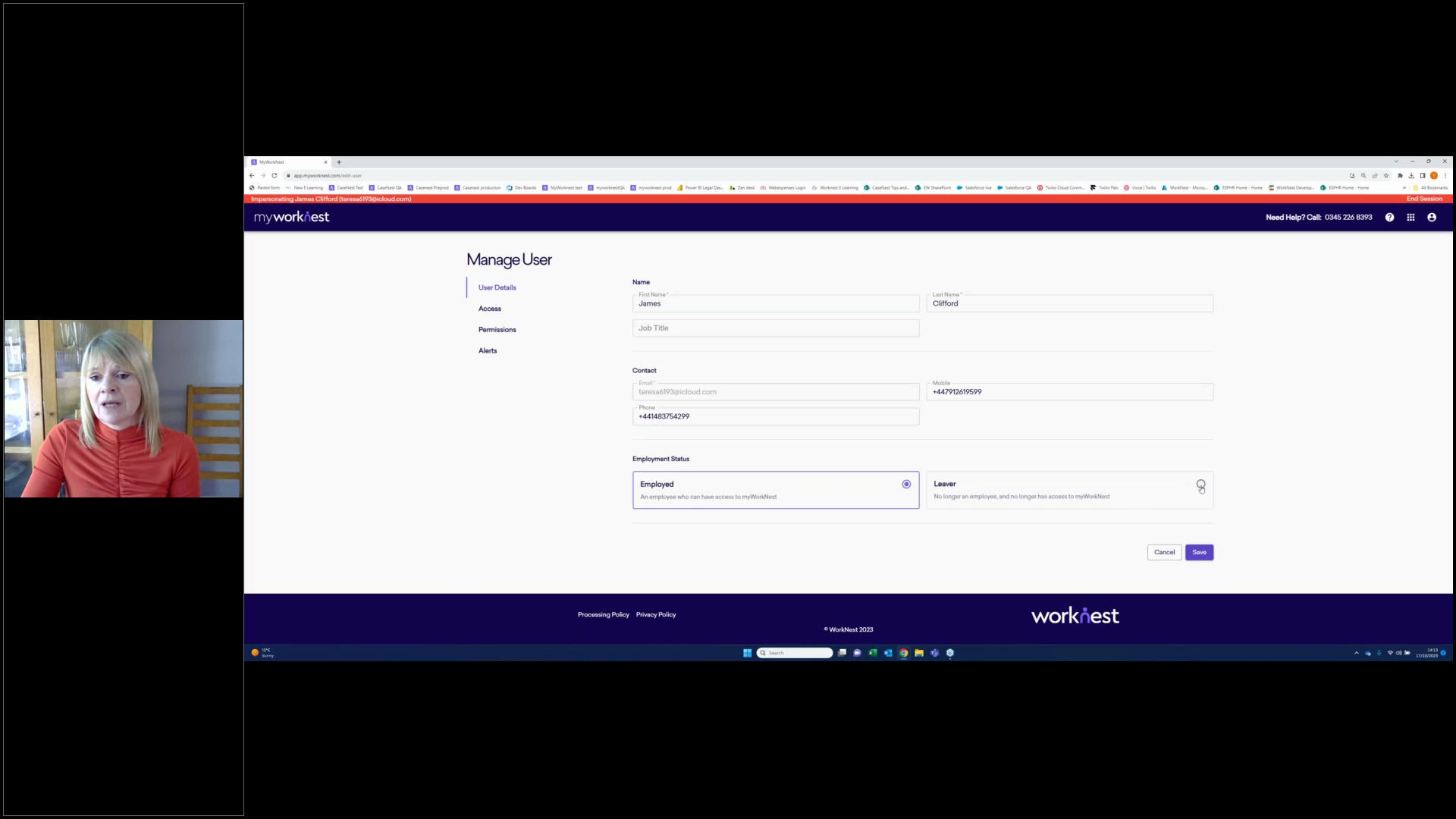

myWorkNest - Administration Guide

Guide

myWorkNest - Troubleshooting Guide

Guide

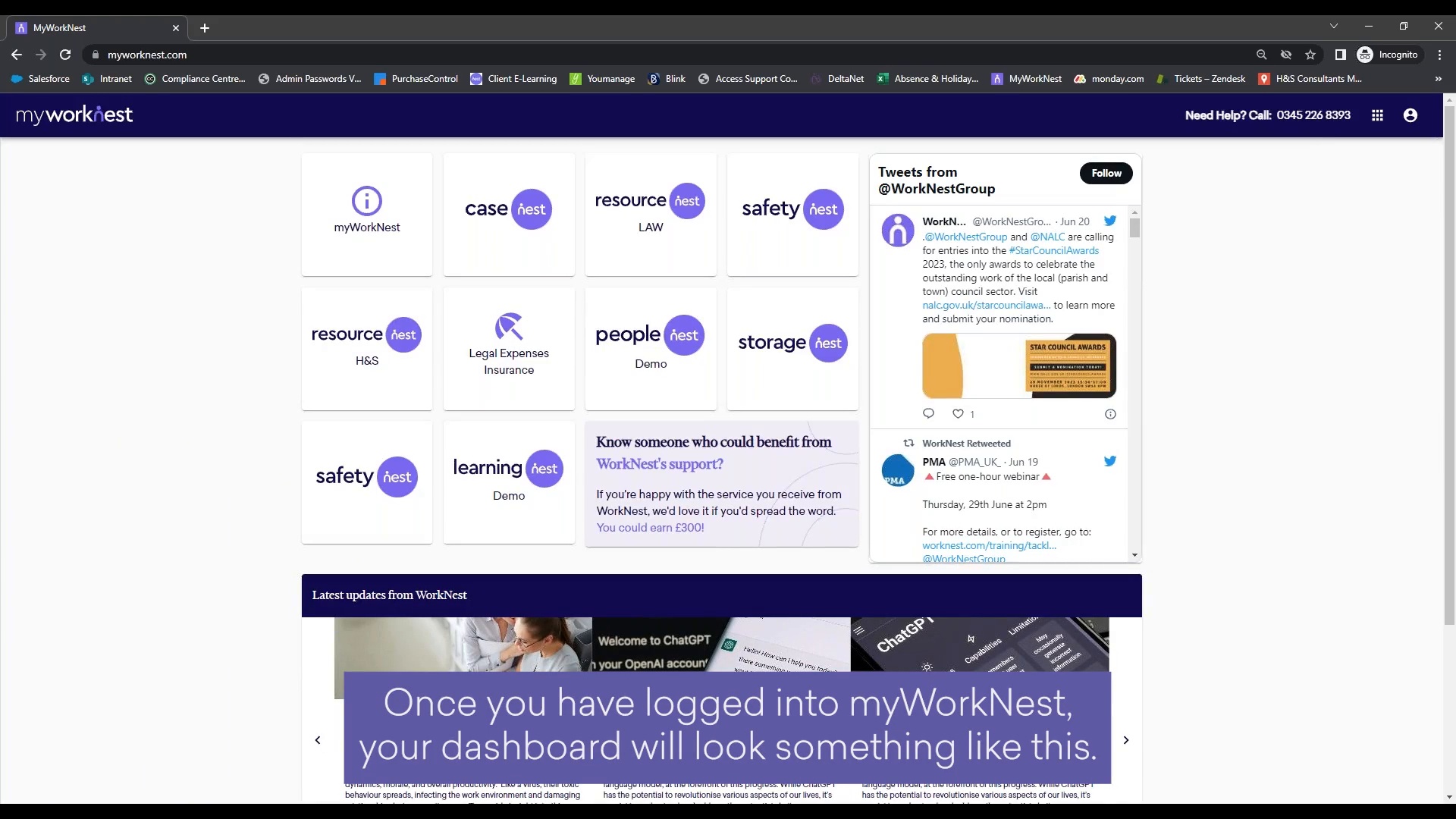

myWorkNest Onboarding Video

Onboarding Video7 minutes 10 seconds

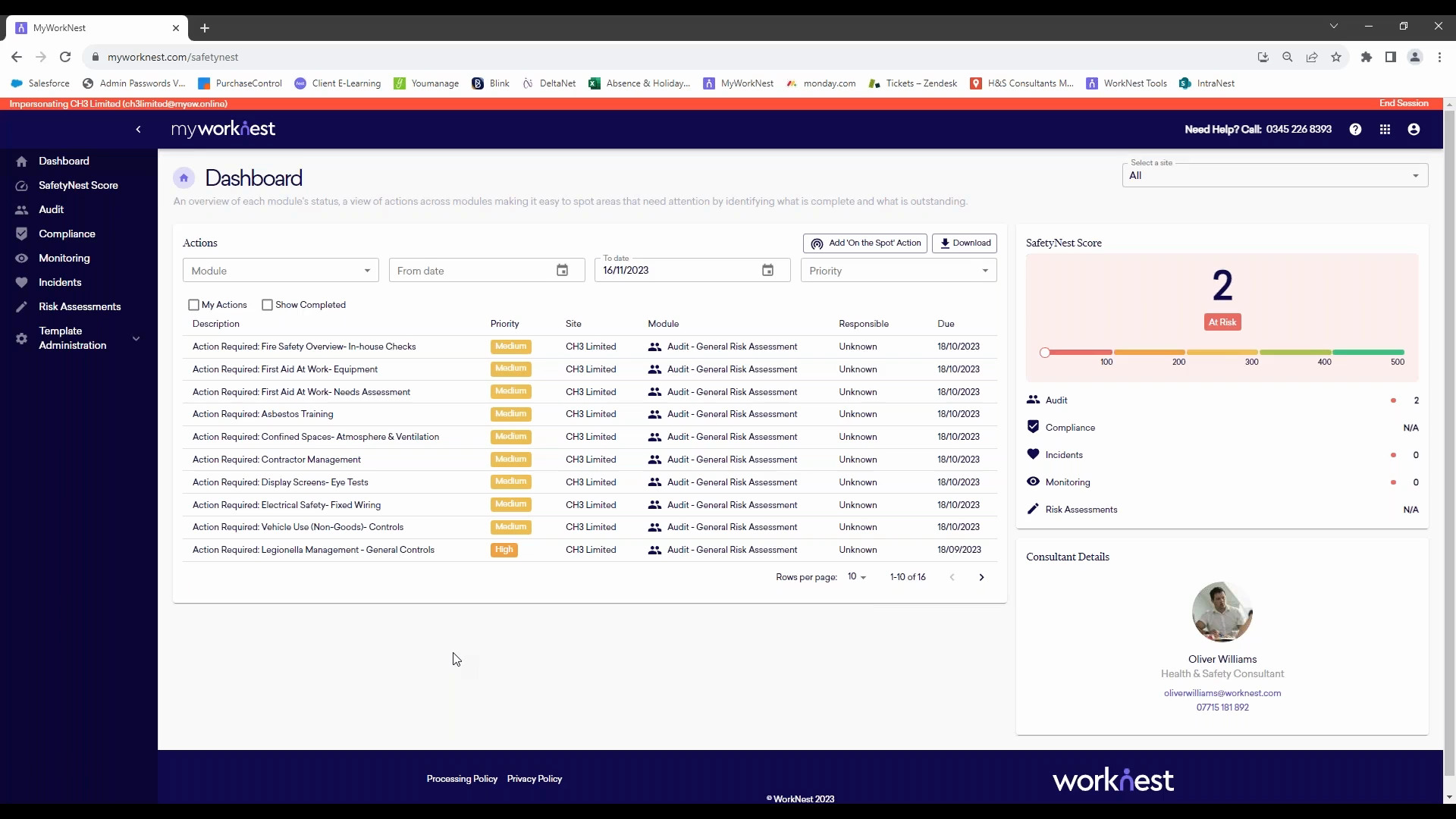

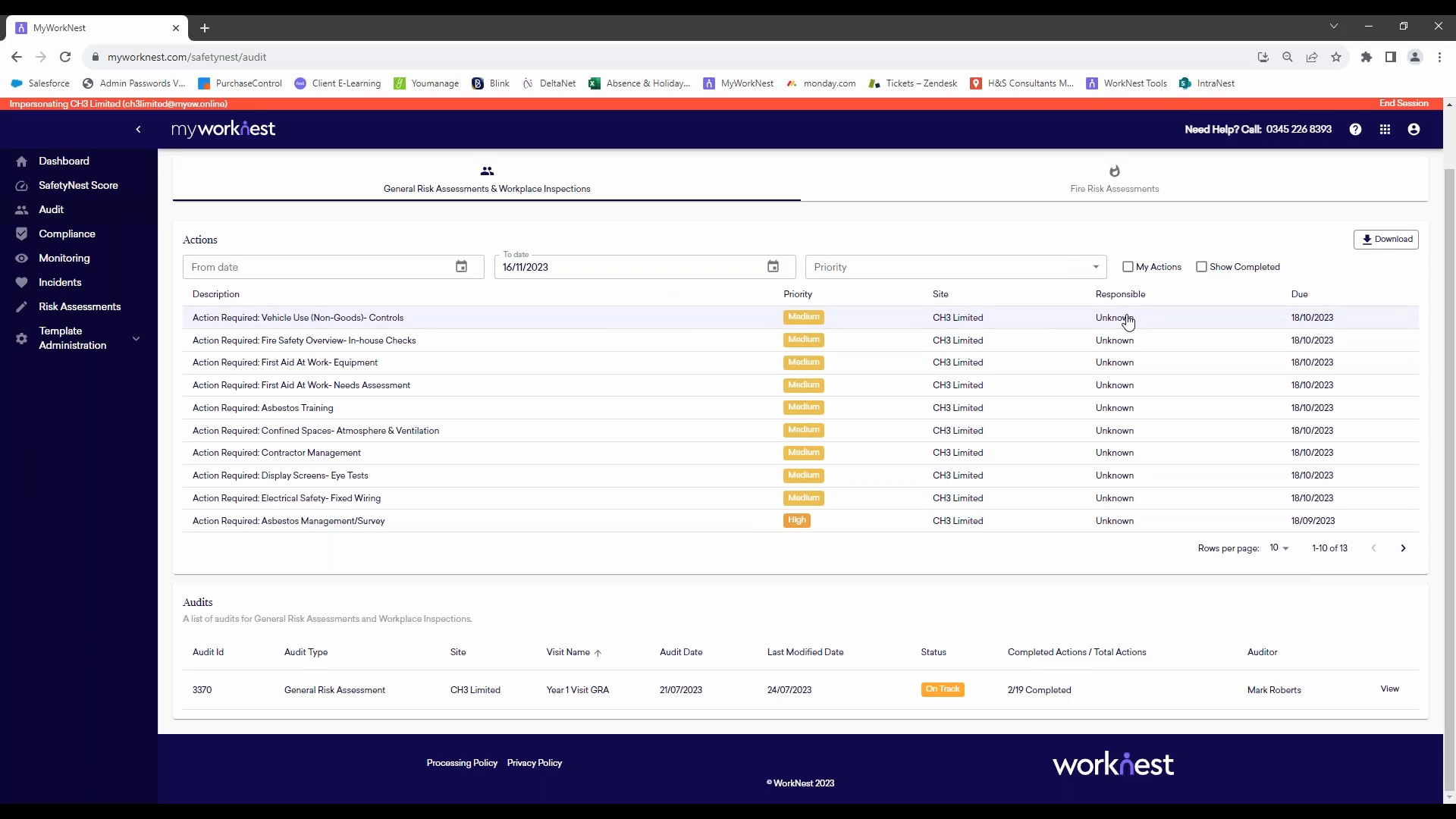

2. SafetyNest Bitesize Video - Audit

Bitesize Video2 minutes 26 seconds

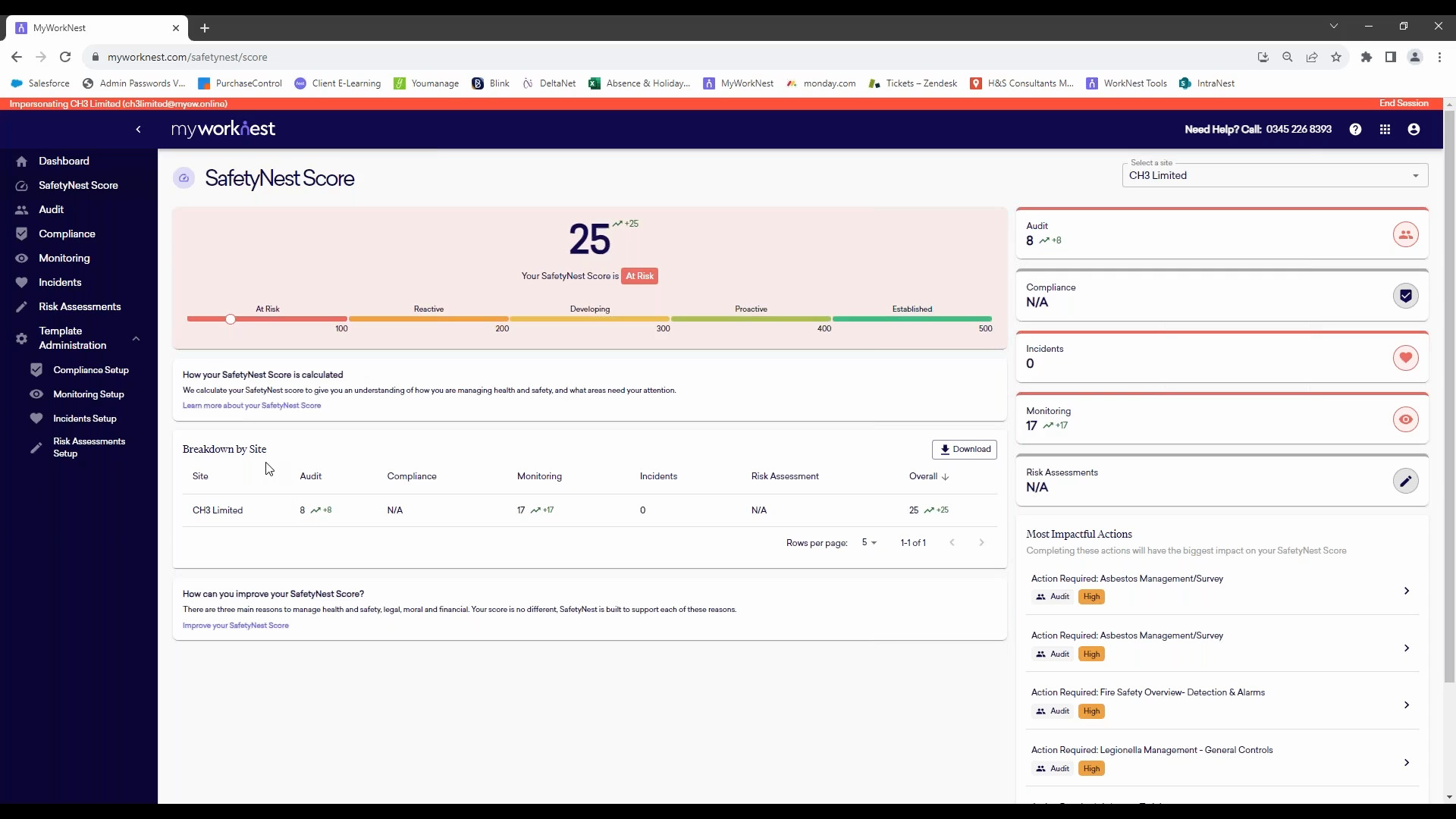

8. SafetyNest Bitesize Video - Scores

Bitesize Video3 minutes 29 seconds

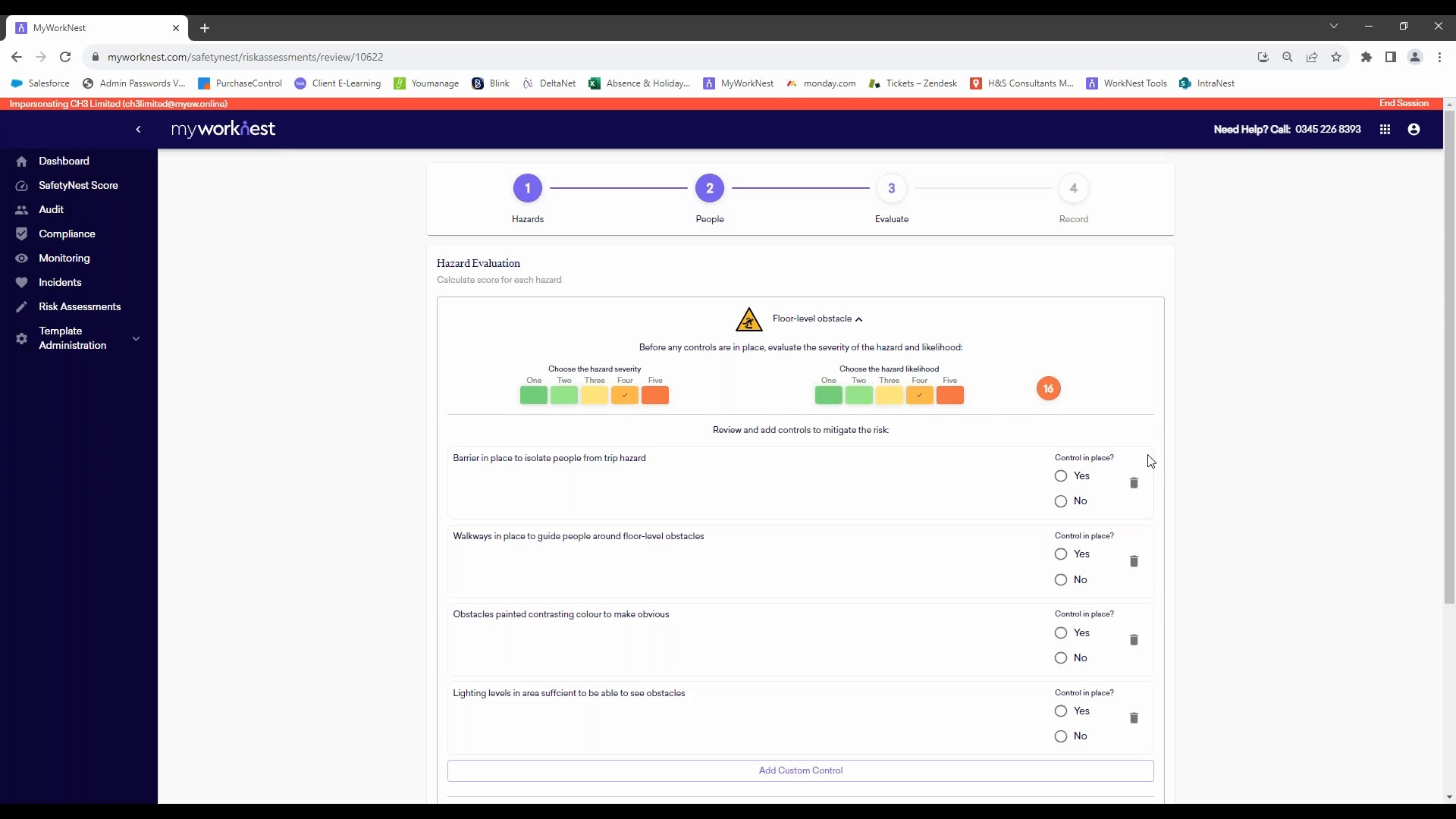

6. SafetyNest Bitesize Video - Risk Assessments

Bitesize Video3 minutes 28 seconds

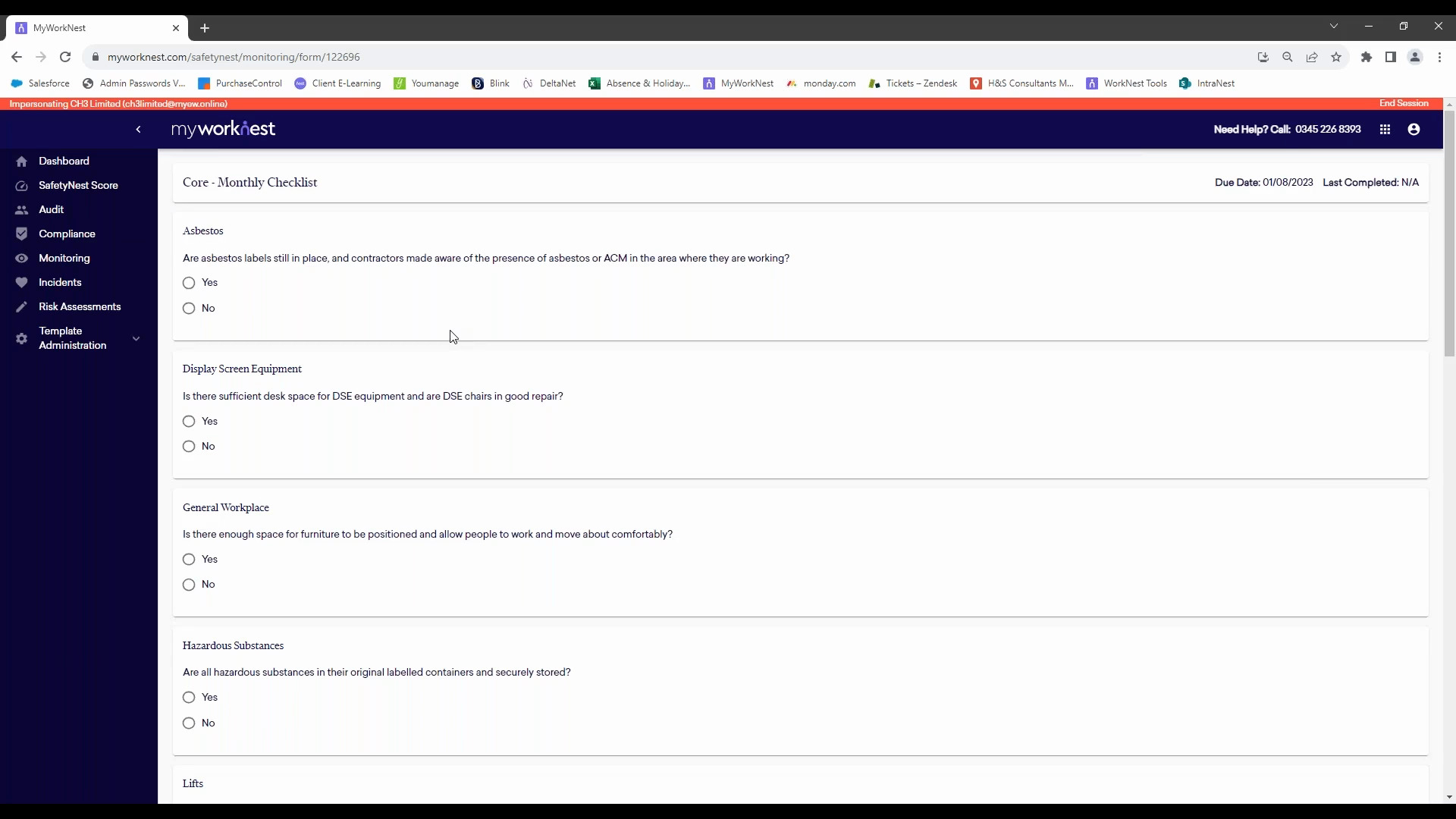

4. SafetyNest Bitesize Video - Monitoring

Bitesize Video3 minutes 17 seconds

1. SafetyNest Bitesize Video - Introduction

Bitesize Video23 seconds

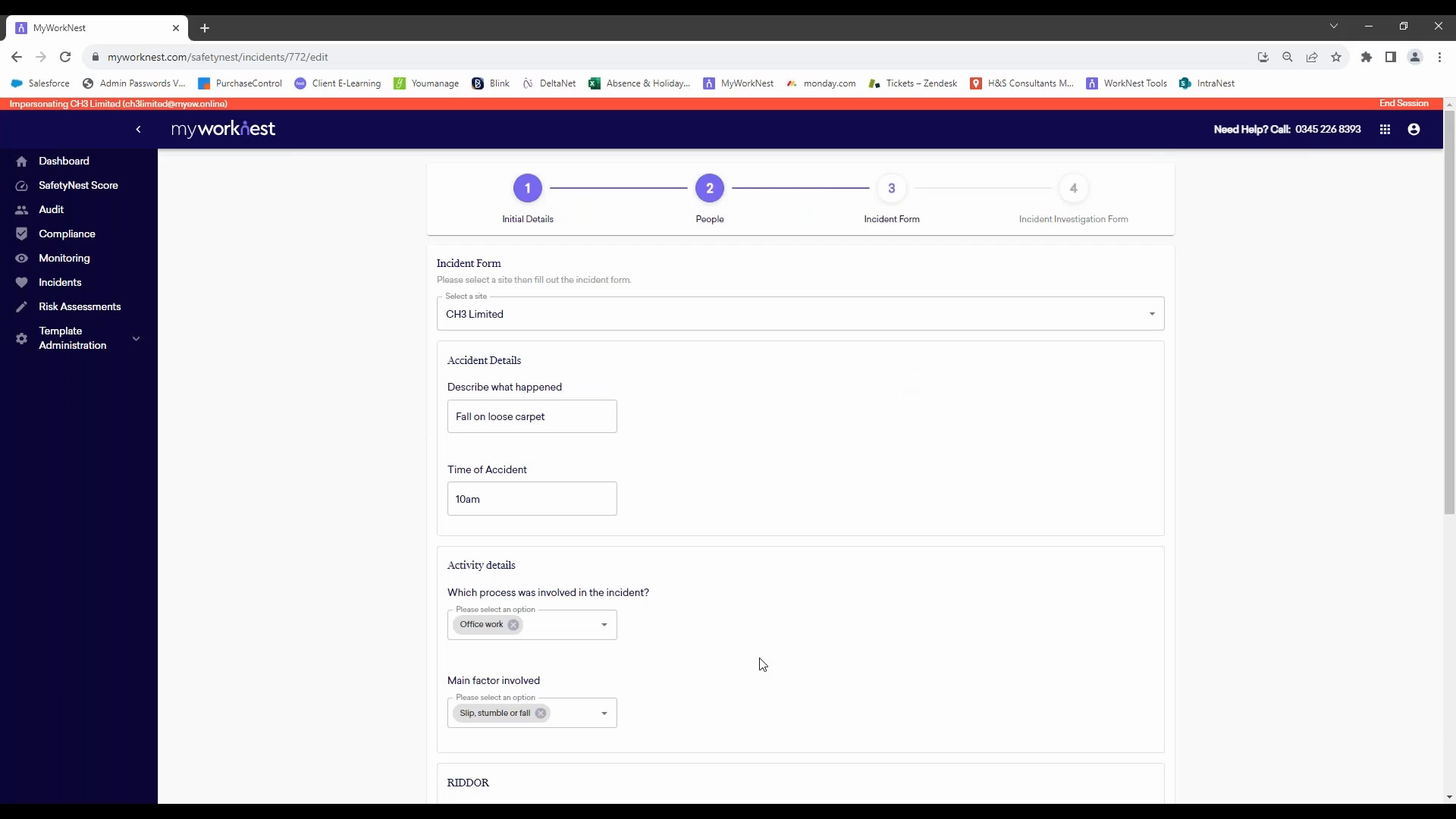

5. SafetyNest Bitesize Video - Incidents

Bitesize Video3 minutes

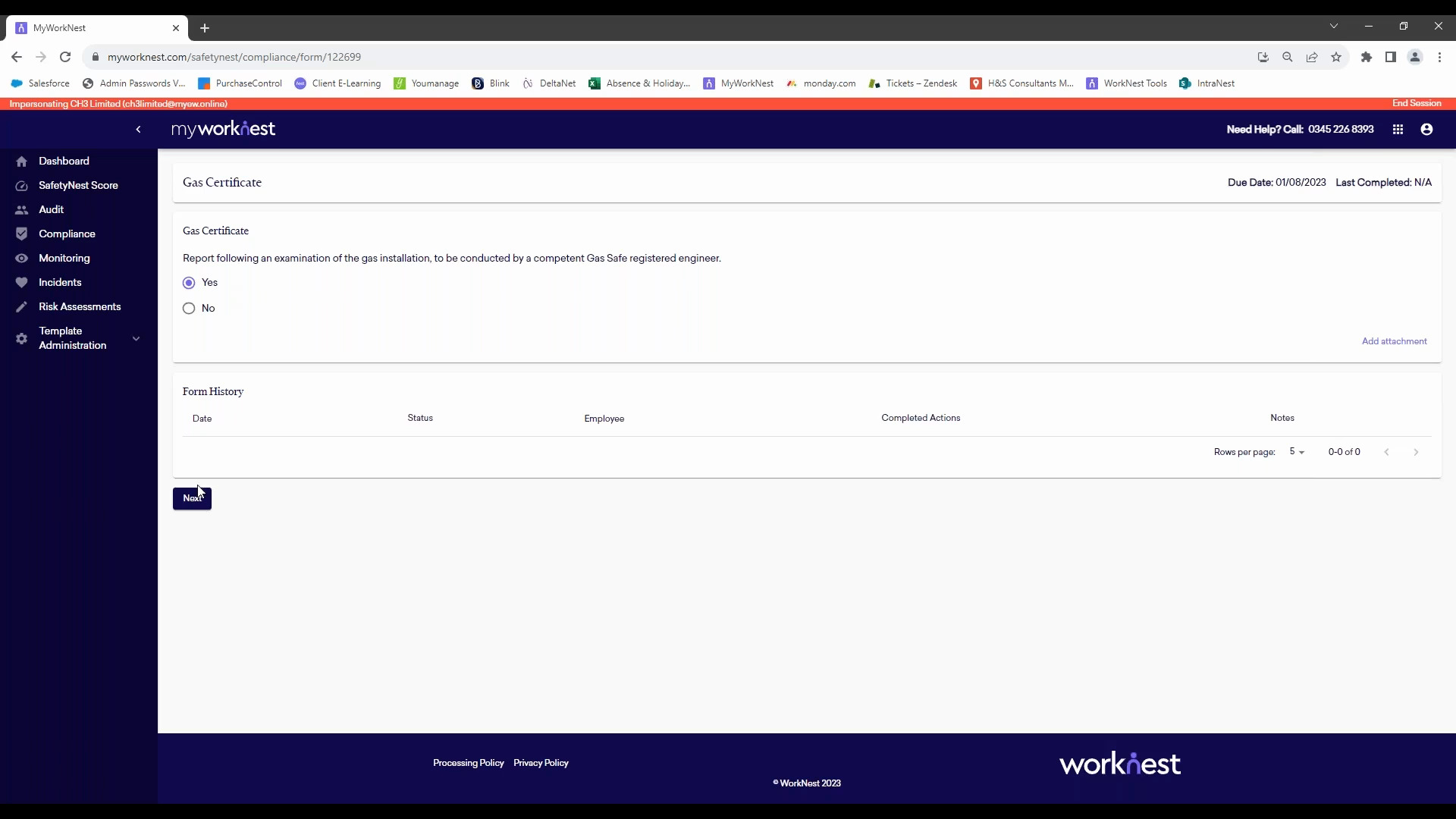

3. SafetyNest Bitesize Video - Compliance

Bitesize Video3 minutes 10 seconds

Social media | Managing the recent surge in unfiltered personal posts

Blog28 Sep 2023

COVID, concrete and other concerns | Handling refusals to work on health and safety grounds

Blog21 Sep 2023

Artificial Intelligence in the Workplace Policy

Template14 Sep 2023

TUPE update | Court confirms share incentive plans CAN transfer across

Blog13 Sep 2023

Guide to Inclusive Language in the Workplace

Guide04 Sep 2023

Responding to the RAAC concrete crisis | Safety measures for schools and other sectors

Blog01 Sep 2023

Confronting 10 Workplace Toxicity Challenges | live Q&A with legal and HR experts

Webinar31 Aug 2023

Bullying bosses | Spotting the problem and potential strategies

Blog24 Aug 2023

Ready, set, match | Your gameplan for workplace harmony during the Women’s World Cup final

Blog17 Aug 2023

Proving the problem | How to evidence poor employee behaviour

Blog11 Aug 2023

Flexible Working Act 2023 | A fundamental shift or a fuss over nothing?

Blog03 Aug 2023

Bullying and Harassment Guidance Note

Guide28 Jul 2023

Bullying and Harassment Policy

Template28 Jul 2023

How to manage sickness absence during an ongoing HR process

Blog26 Jul 2023

Guide to Tackling Toxicity in the Workplace

Guide17 Jul 2023

10 Top Tips | Having Difficult Conversations With Difficult Employees

Guide17 Jul 2023

Crumbling classrooms | Watchdog report shines light on unsafe school buildings

Blog14 Jul 2023

HSE’s fatal injury statistics 2022/23 suggest workplaces are no safer than in 2016

Blog06 Jul 2023

Tackling Toxic Behaviours in the Workplace

Webinar29 June 2023

ASVA partners with WorkNest to provide Employment Law, HR and Health & Safety advice to its members

News - Press Release27 Jun 2023

Manchester High School for Girls

Customer Story - PDF

Game and Wildlife Conservation Trust

Customer Story - PDF

Buxton Crescent Hotel - Customer Story

Customer Story - PDF

WorkNest survey shows 70% of toxic behaviour in the workplace goes unresolved

Blog14 Jun 2023

ChatGPT and the workplace | Minimising the risk of employee misuse

Blog14 Jun 2023

ChatGPT and the workplace | Protecting your recruitment process against AI-related issues

Blog09 Jun 2023

ChatGPT and the workplace | Addressing concerns around job security

Blog09 Jun 2023

False fires | Fire services in Scotland to stop attending automatic alarm call outs from 1 July

Blog06 Jun 2023

Updating the Equality Act definition of ‘sex’ | ECHR opinion and considerations for the workplace

Blog30 May 2023

Reasonable adjustments for mental health | Acas publishes new guidance for employers

Blog19 May 2023

Guide to Employment Law Changes 2023

Guide17 May 2023

Fee for Intervention | Why health and safety breaches could cost your business more in 2023

Government abandons ‘sunsetting’ provisions of Retained EU Law Bill

Blog12 May 2023

Addressing Sickness, Performance and Capability Concerns | Exeter

Exeter Employment Law and HR Seminar 22 June

Addressing Sickness, Performance and Capability Concerns | Birmingham

Birmingham Employment Law and HR Seminar 20 June

Addressing Sickness, Performance and Capability Concerns | Newcastle

Newcastle Employment Law and HR Seminar 15 June

Addressing Sickness, Performance and Capability Concerns | Bristol

Bristol Employment Law and HR Seminar 13 June

Addressing Sickness, Performance and Capability Concerns | Glasgow

Glasgow Employment Law and HR Seminar 08 June

Addressing Sickness, Performance and Capability Concerns | London AM Session

London Employment Law and HR Seminar06 June 2023 - Morning Session

Employment Law Update | changes to family-friendly rights and flexible working

Webinar27 April 2023

Virtual Health and Social Care Seminar | employment reforms, recruitment and CQC regulations

Webinar26 Apr 2023

Retail Employment Law Update | reducing hours, redundancies and apprenticeship rules

Webinar20 April 2023

Conduct v Performance Guide

Guide06 Apr 2022

The Definitive Employer's Guide to Paternity Leave and Pay

Guide23 Mar 2023

The Definitive Employer's Guide to Maternity Leave and Pay

Guide23 Mar 2023

6 common long-term sick leave frustrations – and why you can’t just dismiss

Blog22 Mar 2023

New WorkNest Survey Identifies Alarming Link Between Financial Pressures and Employee Underperformance

News - Press Release14 Mar 2023

WorkNest at CIPD Scotland Annual Conference 2023

Exhibition 30 Mar 2023

Employment Law, HR and Health & Safety Support for MATS and Academies Brochure

Brochure

Solving Sickness and Performance Problems

London Employment Law and HR Seminar21 Mar 2023 - Afternoon Session

Solving Sickness and Performance Problems

London Employment Law and HR Seminar22 Mar 2023 - Afternoon Session

‘Picking on’ or performance managing? How to address grievances from ‘sensitive’ staff

Blog28 Feb 2023

King’s Coronation bank holiday | Do employees have a right to time off on 8 May?

Blog24 Feb 2023

Disability harassment in the workplace | Is ignorance an excuse?

Blog24 Feb 2023

Managing Performance Issues | following a fair process, unexpected grievances and dismissals

Webinar23 Feb 2023

Health and safety culture | 7 ways to engage your employees in workplace health and safety

Blog22 Feb 2023

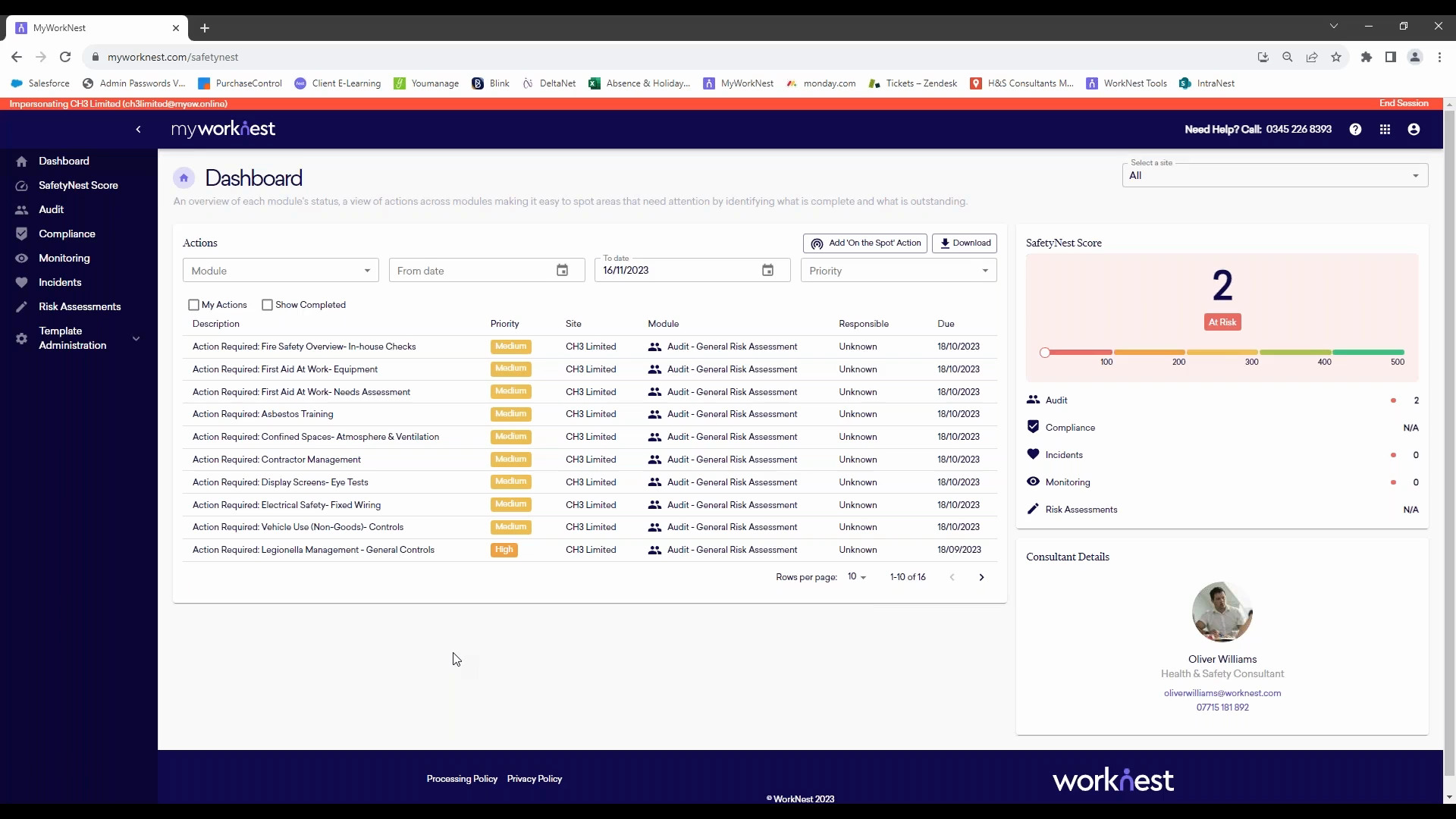

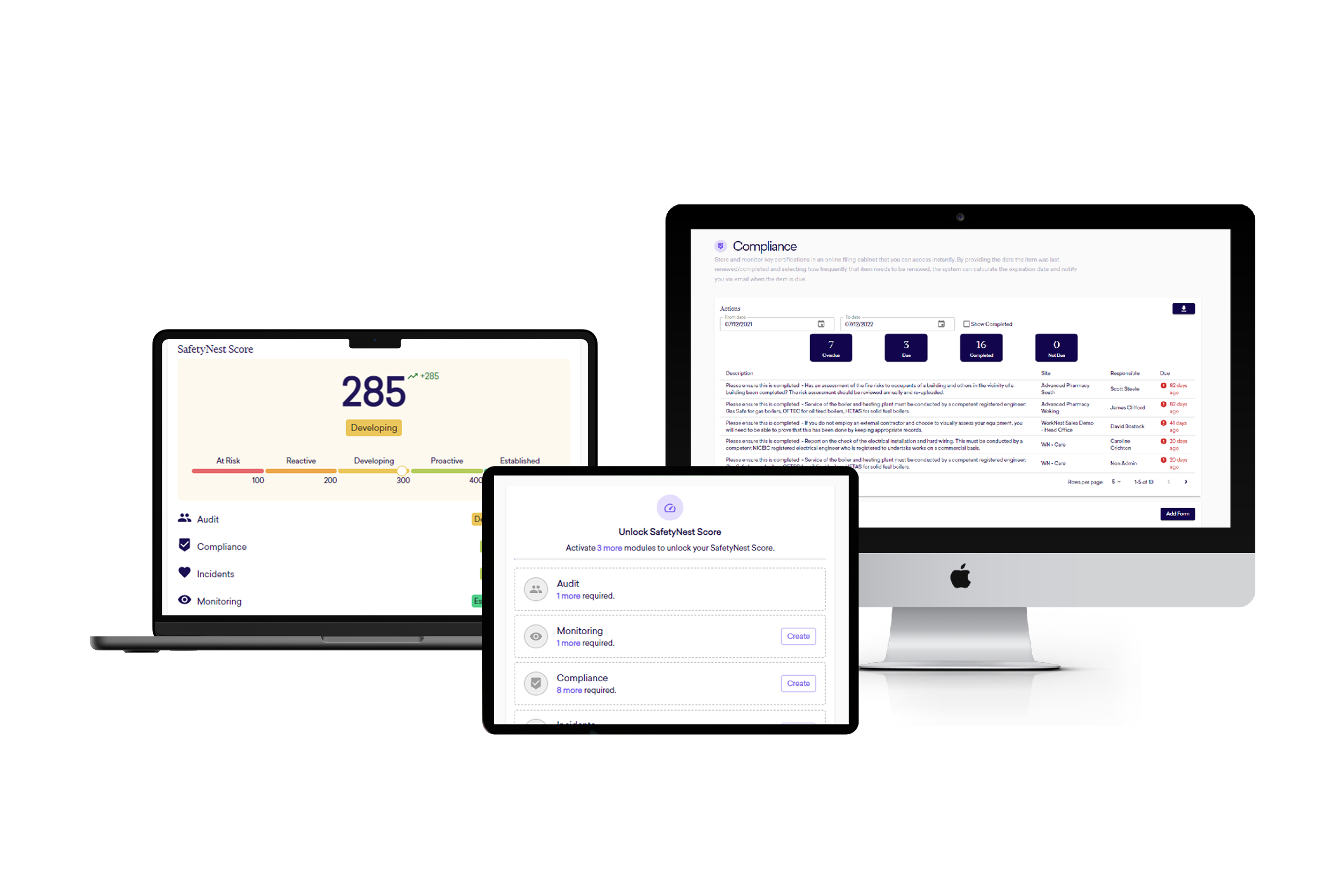

WorkNest Launches SafetyNest to Help Businesses Mitigate Rising Health and Safety Penalties for Non-Compliance

News22 Feb 2023

Quick-Fire Guide to the Fire Safety Regulations

Guide17 Feb 2023

Example Redundancy Selection Matrix

Template17 Feb 2023

Short Guide to Supporting Staff Through Redundancy

Guide17 Feb 2023

10-Step Guide to Redundancy

Guide17 Feb 2023

Solving Sickness and Performance Problems

London Employment Law and HR Seminar22 Mar 2023

Solving Sickness and Performance Problems

London Employment Law and HR Seminar21 Mar 2023

Solving Sickness and Performance Problems

Reading Employment Law and HR Seminar16 Mar 2023

Solving Sickness and Performance Problems

Manchester Employment Law and HR Seminar14 Mar 2023

Solving Sickness and Performance Problems

Glasgow Employment Law and HR Seminar07 Mar 2023

Solving Sickness and Performance Problems

Liverpool Employment Law and HR Seminar02 Mar 2023

Teacher strikes | 10 things schools need to know about industrial action

Blog09 Feb 2023

Remote redundancy | Is consultation via Zoom, email or phone legal?

Blog30 Jan 2023

The future of fire and rehire | Could a new Code of Practice put a stop to pay cut ultimatums?

Blog02 Feb 2023

Industrial Action FAQ for Schools

Guide30 Jan 2023

Redundancy | Giving staff paid time off to job hunt

Blog27 Jan 2023

Redundancy and Restructuring | process, people and protecting your business

Webinar26 Jan 2023

Health and Safety in Schools | An Introduction to our Four Pillar Approach

Guide25 Jan 2023

Education Breakfast Briefing | industrial action and strikes in schools

Webinar24 Jan 2023

Government launches consultation on holiday pay entitlement for part-year workers

Blog13 Jan 2023

7 key strategies to avoid redundancies

Blog10 Jan 2023

Are you in a redundancy situation?

Blog09 Jan 2023

10 top health and safety tips

Blog04 Jan 2023

Fair and unfair dismissals

Blog04 Jan 2023

8 New Year’s health and safety resolutions your business should consider

Blog04 Jan 2023

6 key ingredients of a solid sickness absence policy

Blog03 Jan 2023

HSE statistics for education show significantly higher rates of stress – and a possible safety plateau

Blog05 Dec 2022

HSE statistics 2022 reveal a sharp rise in worker injuries

Blog23 Nov 2022

5 Ways to Support Your Staff Financially

Guide17 Nov 2022

Cost of doing business crisis | Moving forward with staff on long-term sick leave

Blog14 Nov 2022

Could the cost of living crisis provide a catalyst for holiday pay claims?

Blog07 Nov 2022

HSE statistics for education show significantly higher rates of stress and a possible safety plateau

Blog05 Nov 2022

HR's Guide to the Retained EU Law (Revocation and Reform) Bill

Guide02 Nov 2022

Single points of failure | How recruitment and retention challenges might impact health and safety

Blog28 Oct 2022

The recent rise in settlement agreements – and employees refusing to sign them

Blog24 Oct 2022

Cost of Living | 5 ways to support your employees' financial wellbeing

Webinar20 Oct 2022

Cost of living bonuses | What employers need to know before providing financial perks

Blog14 Oct 2022

Menopause in the Workplace | Some regulations to be aware of

Video 07 Oct 2022

WorkNest at CIPD Annual Conference and Exhibition 2022

Exhibition 9 & 10 Nov 2022

Menopause Risk Assessment (Person-Centred) Template

Template 05 Oct 2022

Q&A on Managing Menopause in the Workplace with Sarah Bunker, Senior Solicitor

Blog 04 Oct 2022

Coping with the cost of living | Managing employees’ drug and alcohol misuse

Blog27 Sep 2022

Harpur Trust v Brazel FAQ

Guide21 Sep 2022

How to Calculate Holiday Entitlement and Pay | urgent update for employers

Webinar08 Sep 2022

Protected Characteristics 101

Guide08 Sep 2022

The recent rise of grievances involving gaslighting

Blog07 Sep 2022

Court confirms whistleblowers can be fairly dismissed over conduct

Blog30 Aug 2022

Protected Characteristics 101

Webinar18 August 2022

Short Guide to Long COVID

Guide18 Aug 2022

Managing Menopause in the Workplace

Webinar11 Aug 2023

Managing Menopause in the Workplace

Webinar11 Aug 2022

Menopause | Legislative reforms that may be coming down the track

Blog11 Aug 2022

Esp Law and HR Solutions UK Selected as Finalists in Personnel Today Awards 2022

Blog08 Aug 2022

Revealed: the common root causes behind ‘wholly avoidable’ workplace accidents

Blog03 Aug 2022

5 high health and safety fines from the second quarter of 2022

Blog01 Aug 2022

Preparing for the New CQC Framework: 101 for Care Home Providers

Guide27 Jul 2022

Guide to Managing Menopause in the Workplace

Guide27 Jul 2022

How Better Health and Safety Practices Can Improve Your Claims Defensibility

Webinar27 Jul 2022

Harpur Trust v Brazel | Supreme Court confirms pro-rating holiday pay for part-year workers is unlawful

Blog20 Jul 2022

Maintaining Standards of Care

Webinar20 Jul 2022

WorkNest’s HR and Employment Law service strengthened by Vista acquisition

News - Press Release19 Jul 2022

Reduced Workforce Health & Safety Checklist

Checklist15 Jul 2022

Menopause Policy

Template15 Jul 2022

Performance Management Flowchart

Guide15 Jul 2022

Guide to Safe School Trips

Guide15 Jul 2022

Recruitment Checklist for Schools

Guide14 Jul 2022

Individual Stress Risk Assessment

Template14 Jul 2022

Quarterly Breakfast Briefing for School Leaders | legally compliant recruitment and safe school trips

Webinar13 Jul 2022

HSE statistics | Some progress but fatal injury rate remains ‘broadly flat’

Blog12 Jul 2022

SME End-to-End Employee Management Brochure

Brochure

Easier access to fit notes | Good or bad news for employers?

Blog08 Jul 2022

BeaverFit - Customer Story

Customer Story - PDF

Menopause at work | An employer's guide

Blog30 Jun 2022

6 absence challenges to prepare for this summer

Blog30 Jun 2022

Performance Managing Staff With Medical Conditions

Webinar28 Jun 2022

6 common health and safety training mistakes | Top tips for getting it right

Blog24 Jun 2022

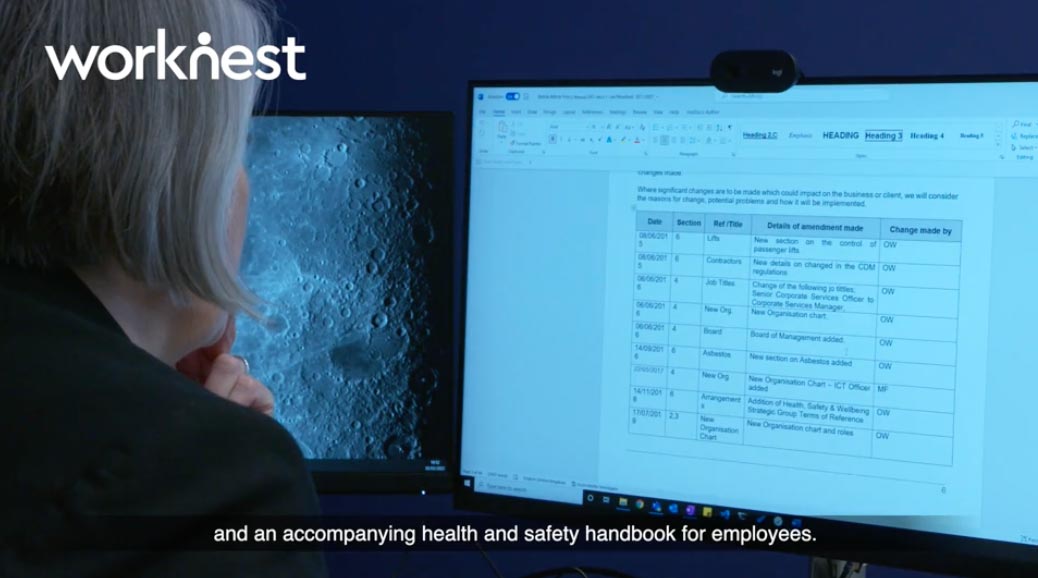

WorkNest's Fixed-Fee Health & Safety Support - Policies and Handbooks

Video

WorkNest's Fixed-Fee Health & Safety Support - Dedicated Health & Safety Consultant

Video

WorkNest's Fixed-Fee Health & Safety Support

Video

WorkNest's Fixed-Fee Employment Law & HR Advisory Service - Litigation Support

Video

WorkNest's Fixed-Fee Employment Law & HR Advisory Service - Contracts & Handbooks

Video

WorkNest's Fixed-Fee Employment Law & HR Advisory Service - Advice Line

Video

Safe reoccupation | 5 health and safety checks you might have missed

Blog10 Jun 2022

Reduced Workforce Health and Safety Guide

Guide08 Jun 2022

Guide to Dismissing Employees Who Pull Frequent Sickies

Guide08 Jun 2022

Stranded staff | What to do when employees can’t work due to flight cancellations

Blog07 Jun 2022

HR Solutions acquisition grows WorkNest’s HR and Health & Safety service

News - Press Release06 Jun 2022

No jab, no job dismissals in the Employment Tribunal

News - Scottish Legal News30 May 2022

Holiday pay calculations for part-year workers could be about to change again – here’s why

Blog26 May 2022

Work from wherever? | Things to consider before allowing employees to work from abroad

Blog25 May 2022

Employee Wellbeing | supporting line managers in the new working world

Webinar19 May 2022

Employment Law Update | reluctant returners, misconduct and holiday pay calculations

Webinar18 May 2022

Reduced workforce? Here’s 5 health and safety areas you need to revisit

Blog18 May 2022

Fee for Intervention | Why health and safety breaches could cost your business more in 2022

Blog16 May 2022

Remote work isolation | How employers can help combat loneliness

Blog12 May 2022

Recent cases highlight continued work at height failings

Blog06 May 2022

Retail Recovery | restructuring, safety risks and staff absence

Webinar05 May 2022

Managing organisational change | How to keep people happy

Blog04 May 2022

Homeworking Risk Assessment Template

Template28 Apr 2022

Initial Audit Form

Template28 Apr 2022

Symptoms Chart

Poster28 Apr 2022

Can You Be 100% Health and Safety Compliant All the Time?

Webinar21 Apr 2022

5 ways to combat 2022’s recruitment challenges when you can’t pay more

Blog15 Apr 2022

A war of words | Managing employees’ political views on the Russia-Ukraine conflict

Blog13 Apr 2022

Outdoor Visiting Protocol - Care Homes

Template11 Apr 2022

Indoor Visiting Protocol - Care Homes

Template11 Apr 2022

PPE for Visitors - Care Homes

Guide11 Apr 2022

Homeworking Checklist and DSE Risk Assessment

Template11 Apr 2022

Homeworking and Health & Safety FAQ

Guide11 Apr 2022

Visiting Proforma - Care Homes (Scotland)

Template11 Apr 2022

Visiting Proforma - Care Homes (England)

Template11 Apr 2022

Investigation Form

Template11 Apr 2022

Testing Record

Template11 Apr 2022

Reoccupation Checklist

Template11 Apr 2022

Homeworkers' Guide to Health and Wellbeing

Guide11 Apr 2022

Health and Wellbeing Policy

Template11 Apr 2022

Staff side hustles | 10 employer questions answered

Blog07 Apr 2022

Face Coverings Policy

Template05 Apr 2022

Lay-Offs Guidance Note

Guide05 Apr 2022

Homeworking and Employment Law Guide

Guide05 Apr 2022

Home/Hybrid Working Policy

Template05 Apr 2022

Collective Consultation FAQ

Guide05 Apr 2022

Agreement to Homeworking Letter

Template05 Apr 2022

Vaccination FAQ (Northern Ireland)

Guide05 Apr 2022

Vaccination FAQ (Wales)

Guide05 Apr 2022

Vaccination FAQ (Scotland)

Guide04 Apr 2022

Vaccination FAQ (England)

Guide05 Apr 2022

Vaccination and Testing Guide

Guide05 Apr 2022

SSP - When is it Payable?

Guide05 Apr 2022

Refusals to Return to Work Guide

Guide05 Apr 2022

Post-Lockdown FAQ

Guide05 Apr 2022

Living With COVID Guide

Guide05 Apr 2022

International Travel and COVID Guide

Guide05 Apr 2022

Immunisation and Testing Policy

Template05 Apr 2022

Holidays (Travelling Abroad and Quarantine) Policy

Template05 Apr 2022

Compulsory Vaccination in Care Homes Guide

Guide05 Apr 2022

Compulsory Vaccination for Frontline HSC Workers Guide

Guide05 Apr 2022

Common Employment Scenarios

Guide05 Apr 2022

Common Employment Scenarios - Education

Guide05 Apr 2022

Care Home Immunisation Policy

Template05 Apr 2022

Absences and Refusals to Work FAQ

Guide05 Apr 2022

Employing people with autism

Blog04 Feb 2022

April Fools | Are employers liable for office horseplay and pranks gone wrong?

Blog01 Apr 2022

Cutting Workforce Costs | redundancies, settlements and changing T&Cs

Webinar31 Mar 2022

Conduct at work events | How should employers handle a Will Smith type situation?

Blog29 Mar 2022

What does ‘living with Covid’ mean for your workplace?

News - Arts Professional23 Mar 2022

Diversity and inclusion in the workplace | The state of play in 2022

Blog17 Mar 2022

Living with COVID | Keeping your workforce safe once restrictions are scrapped

Blog16 Mar 2022

Progressive HR policies for forward-thinking employers

News - People Management14 Mar 2022

Living with COVID | What if my employee tests positive?

Blog11 Mar 2022

Using the Hierarchy of Controls to make sensible safety decisions

Blog12 Mar 2022

Dealing with workplace disputes | 5 policies to have in your arsenal

Blog09 Mar 2022

The war in Ukraine | Employer considerations

Blog09 Mar 2022

Respect for one another at work means adopting diversity best practices

News - Insider08 Mar 2022

Living With COVID | the implications for staff, safety and the workplace

Webinar04 Mar 2022

Employment Facts & Figures Reference Guide 2022

Guide03 Mar 2022

How to manage health and safety as a governor or trustee

Blog02 Feb 2022

Luker Rowe - Customer Story

Customer Story - PDF

Tackling Top Employment Law Issues in the Third Sector

Webinar22 Feb 2022

Health and safety | 3 leadership lessons from the world of sport and politics

Blog22 Feb 2022

5 ways to improve workers’ heart health

Blog21 Feb 2022

"Get back to work" | Will PM's decision to end all COVID rules cause headaches for HR?

News - HR Grapevine22 Feb 2022

LORNA GEMMELL: WHAT IS THE NATIONAL DISABILITY STRATEGY?

News - HR Review16 Feb 2022

Cost of living crisis | HR 'under pressure' to help staff as inflation outpaces wage growth AGAIN

News - HR Grapevine15 Feb 2022

How to manage workplace romances | Problems, policies and possible legal risks

Blog14 Feb 2022

Valentine's Day | Should HR have an office romance policy?

News - HR Grapevine14 Feb 2022

Revisiting performance management | How to avoid legal risks when getting your team back on track

Blog11 Feb 2022

'Conflict & confusion' | HR at risk of legal battles with staff as last COVID rules set to end early

News - HR Grapevine10 Feb 2022

So what ARE the rules for the workplace now that Boris has declared Covid is OVER?

News - Mail Online09 Feb 2022

WorkNest Asks Whether: It's possible to be 100% compliant 100% of the time

Blog08 Feb 2022

'Painful abuse' | Tesla HR accused of punishing staff who complained of 'rampant' racism

News - HR Grapevine08 Feb 2022

Reminder to Take Holidays Memo

Template07 Feb 2022

Letter to Long-Term Sick Leave Employee Regarding Holidays

Template07 Feb 2022

World Cancer Day: An employer’s handbook

Blog04 Feb 2022

Worker who took unpaid leave due to mislabelled employment status wins holiday pay claim

Blog03 Feb 2022

10 common health and safety policy mistakes | Top tips for getting it right

Blog01 Feb 2022

HR experts reveal how THEY would conduct a Downing Street party investigation

News - HR Grapevine01 Feb 2022

Pros and cons of the four-day working week

Blog01 Feb 2022

Mind the Gap | Health and Safety to Remain a Priority

Webinar01 Feb 2022

Care home worker who refused vaccination was fairly dismissed

Blog26 Jan 2022

Managing Performance Issues | Following a Fair Process, Unexpected Grievances and Dismissals

Webinar25, 26 and 27 Jan 2022

Most employers are still ‘reactive’ when it comes to health and safety

News - Employer News24 Jan 2022

WorkNest appoints new Chief People Officer, Katie Muncaster

News - The Business Desk24 Jan 2022

Revised PPE Regulations | Employers’ duties extended to ALL workers

Blog31 Jan 2022

The protective clauses your contracts might be missing

News - People Management21 Jan 2022

Is your expenses policy fit for hybrid work?

Blog17 Jan 2022

Could employees with anti-vax beliefs be protected under discrimination laws?

Blog13 Jan 2022

Gavin Snell: Reflecting on our first few months as WorkNest – and the future

Blog12 Jan 2022

The nuts and bolts of hybrid working: Expenses and compensation

News - Working Mums11 Jan 2022

Supporting a return to work for staff suffering with long COVID

Blog10 Jan 2022

Guide to Employment Law Changes 2022

Guide07 Jan 2022

Health and safety in education | 5 fines from 2021 and focuses for 2022

Blog4 Jan 2022

The Definitive Employer's Guide to Staff Shortages

Guide24 Dec 2021

How to measure your health and safety performance in 2022 (and why it’s important)

Blog22 Dec 2021

ADVICE FOR EMPLOYERS ON GOVERNMENT'S NEW SICKNESS ABSENCE RULES

News - HR Review22 Dec 2021

SSP changes mean employers cannot demand a doctor’s note until 28 days

Blog21 Dec 2021

HSE annual statistics 2020/21 | The impact of COVID-19

Blog16 Dec 2021

Sexual harassment in the workplace | Where are we now?

Blog16 Dec 2021

Research identifies performance, happiness and trust gap between employers and employees

News - Employer News15 Dec 2021

Diocese of Chichester Academy Trust (DCAT) - Customer Story

Customer Story - PDF

The Manchester Grammar School - Customer Story

Customer Story - PDF

Invite to Discuss Expiry of Fixed-Term Contract

Template14 Dec 2021

Letter Extending or Renewing Fixed-Term Contract

Template14 Dec 2021

Fixed-Term Contracts Guidance Note

Guide14 Dec 2021

Selection of Contractors Checklist

Template14 Dec 2021

Contractors Safety Information

Template14 Dec 2021

Contractor Management Pack

Template14 Dec 2021

How to manage performance in the world of hybrid work

Blog13 Dec 2021

LearningNest e-Learning Pro Education Brochure

Brochure

How can businesses reduce the legal risks of Christmas parties?

News - People Management10 Dec 2021

Plan B | Why working from home is only part of the solution

Blog09 Dec 2021

Employment Law Update | Changes Coming in 2022 and 2021 Case Law Review

Webinar09 Dec 2021

Understanding “reasonably foreseeable” risk in health and safety

Blog07 Dec 2021

Is it time to ditch the employee dress code?

Blog06 Dec 2021

Can I change remote workers' pay?

Blog01 Dec 2021

Omicron | Initial advice for employers

Blog01 Dec 2021

Quarterly Breakfast Briefing for School Leaders | Fixed-Term Contracts and Contractor Management

Webinar01 Dec 2021

HR & Management Training Course Prospectus

Brochure

What makes a good health and safety leader?

Blog25 Nov 2021

Hybrid Working | How to Ensure Fair Treatment and Avoid Discrimination

Webinar25 Nov 2021

Who’s responsible for workplace health and safety?

Blog22 Nov 2021

Only half of employers are confident they’ll treat employees evenly and fairly

News - HR News22 Nov 2021

Firms overestimating employee loyalty after pandemic, research finds

News - People Management22 Nov 2021

Aberdeen Football Club - Customer Story

Customer Story - PDF

The Great Resignation | How can managers turn things around?

Blog17 Nov 2021

Employment Law and Health & Safety Update for South West Businesses

Webinar17 Nov 2021

8 qualities of effective remote managers

Blog16 Nov 2021

Mind the Gap Report

Whitepaper12 Nov 2021

Staff Shortages in Manufacturing | Agency Workers, Contingency Planning and Retention Incentives

Webinar11 Nov 2021

7 protective clauses your contracts may be missing

Blog09 Nov 2021

The Definitive Employer's Guide to Minimum Wage

Guide

Learning about disability AFTER dismissal | Is it still discrimination?

Blog02 Nov 2021

So you’ve decided to allow hybrid working – here’s 3 questions you may have now

Blog01 Nov 2021

Discrimination | Can menopause be classed as a disability?

Blog01 Nov 2021

Contractors and volunteers | Are you overlooking the health and safety of non-employees?

Blog29 Oct 2021

Autumn Budget 2021 | The key points for employers

Blog28 Oct 2021

What is a Competent Person?

Guide

Guide to Risk Assessments

Guide

CQC Compliance Brochure

Brochure

LearningNest e-Learning Trailer

Video

PeopleNest HR Software Trailer

Video

PeopleNest HR Software Brochure

Brochure

3 progressive HR policies for forward-thinking employers

Blog22 Oct 2021

Making vaccination mandatory | Breaking down the legal position

Blog20 Oct 2021

The dangers of facial recognition | Uber employees bring race discrimination claim

Blog20 Oct 2021

Contracts and Handbooks | Recommended Protections, Remote Working Considerations and Regulatory Updates

Webinar20 Oct 2021

Post-furlough redundancies | What are the alternatives?

Blog15 Oct 2021

HR IN REVIEW 10 – HEALTH AND SAFETY IN THE WORKPLACE WITH NICK WILSON

News - HR in Review Podcast04 Oct 2021

No jab, no sick pay? Morrison’s cuts the amount paid to unvaccinated staff

Blog01 Oct 2021

Estate agent wins sex discrimination claim against employer who refused her flexible working request

Blog01 Oct 2021

Self-isolation rules and vaccination status | How things have changed

Blog01 Oct 2021

Post-COVID Employment Challenges for the Charity Sector

Webinar28 Sep 2021

NICK WILSON: EMPLOYERS’ FOCUS MUST REMAIN ON SAFETY

News - HR Review24 Sep 2021

Gen Z | Keeping up with the demands of the next generation of workers

Blog21 Sep 2021

Do vaccinated employees need to take a PCR test following close contact with a positive COVID-19 case?

Blog20 Sep 2021

With restrictions lifted, what should COVID management look like now?

Blog15 Sep 2021

How to prepare for compulsory vaccination

News - The Care Home Environment14 Sep 2021

Compulsory vaccination in care | 7 steps employers should follow with staff

Blog13 Sep 2021

How the COVID pandemic has changed the perception of workplace health and safety

Blog09 Sep 2021

Putting health first in education

News - Independent Insight (iExcellence magazine)07 Sep 2021

Compulsory Vaccination in Care | Exemptions, Dismissals and Evidence for Inspections

Webinar02 Sep 2021

COVID Update for the Education Sector

Webinar01 Sep 2021

Strengthen your safety culture

News - IOSH Magazine01 Sep 2021

Highest recent health and safety fines, including record-breaking £6.5m penalty

Blog31 Aug 2021

How to investigate an accident or incident in your workplace

Blog26 Aug 2021

Employment law and Covid-19: The key issues

News - Headteacher Update23 Aug 2021

Workplace fatalities increase by more than a quarter

News - People Management20 Aug 2021

Workplace conflict | What it is and ways to manage it

Blog18 Aug 2021

Third of employers expect staff to return to the workplace full time, study finds

News - People Management17 Aug 2021

Facilitation Guidance Note

Guide17 Aug 2021

ABC members gain access to essential business compliance support

News - Sports Insight12 Aug 2021

Will redundancy be unfair if the employer didn’t consider furlough? 2 conflicting cases

Blog11 Aug 2021

Why the pingdemic will continue to create problems for manufacturers

Blog11 Aug 2021

Dealing with Disciplinaries | COVID Rules, Conduct and Other Concerns

Webinar11 Aug 2021

Golf Jobs Partners With Ellis Whittam To Provide Employment Law And Health & Safety Advice To Golf Employers

News - Business Mondays09 Aug 2021

Golf Jobs Partners With WorkNest To Provide Employment Law And Health & Safety Advice To Golf Employers

News - Business Mondays09 Aug 2021

5 lockdown changes Scottish employers need to know about (and what to do now)

Blog05 Aug 2021

Excessive absenteeism | When can employers take action?

Blog04 Aug 2021

Help, my employee won’t return to work

Blog03 Aug 2021

3 strategies for managing stress in the workplace

Blog03 Aug 2021

How to overcome the “generation gap” in the workplace

Blog30 Jul 2021

Relaxing of restrictions | How can retailers reduce risk?

Blog23 Jul 2021

Grievance Guidance Note

Guide22 Jul 2021

Pingdemic panic | Do employees need to self-isolate if notified by the COVID-19 app?

Blog22 Jul 2021

Workplace Conflict | Early Intervention, Estimated Costs and Employment Law

Webinar22 Jul 2021

Top Tips for Carrying Out Mediation

Guide21 Jul 2021

Mask confusion | Can we compel employees to wear face coverings at work?

Blog20 Jul 2021

Employment law SOS | Return to work anxiety and the right to switch off

News - Manufacturing Management20 Jul 2021

Returning to work after ‘freedom day’: what should businesses be doing?

News - People Management20 Jul 2021

Keeping employees safe post-lockdown | 5 things to do now

Blog16 Jul 2021

HSE statistics 2020/21 | More fatalities despite fewer people working?

Blog16 Jul 2021

Managing Work-Related Stress Resulting from Conflict, COVID and Other Causes

Webinar15 Jul 2021

Life After Lockdown | Helping Employers to Plan Ahead

Webinar14 Jul 2021

How to manage mental health related absences

Blog13 Jul 2021

What Risk Control Measures Will Remain in Retail Post-Lockdown?

Webinar13 Jul 2021

Why employees might not be entitled to the 2022 bonus bank holiday

Blog08 Jul 2021

Can (and should) employers mandate masks once restrictions are lifted?

News - People Management08 Jul 2021

Staycations, sickness and self-isolation | How to manage short-term summer absences

Blog05 Jul 2021

CQC Compliance acquisition bolsters Ellis Whittam’s services for health and social care providers

News - Press Release30 Jun 2021

Strengthening Your Sickness and Absence Framework (Suitable for SMEs)

Webinar24 Jun 2021

Being Health & Safety Compliant Video Series

Video Series2021

Here’s what you need to know about staff with ‘gender critical’ views

News - FE Week28 Jun 2021

Many firms uncertain over implementing hybrid working, research finds

News - People Management26 Jun 2021

Employee Induction Checklist

Template24 Jun 2021

Elevate Your Absence Management Framework (Suitable for Large Organisations)

Webinar24 Jun 2021

Six ways school leaders can tackle stress

Blog24 Jun 2021

How good health and safety practices help to reduce absence rates

Blog22 Jun 2021

Settled Status Guidance Note

Guide21 Jun 2021

COVID-19 | 3 ongoing absence challenges for employers

Blog18 Jun 2021

Quarterly Breakfast Briefing for School Leaders | Mental Health and Wellbeing in Education

Webinar17 Jun 2021

Carers Trust - Customer Story

Customer Story - PDF

Cater Leydon Millard acquisition strengthens Ellis Whittam’s employment law service

News - Press Release16 Jun 2021

Cater Leydon Millard acquisition strengthens WorkNest’s employment law service

News - Press Release16 Jun 2021

Almost half of businesses are unprepared for hybrid working, our research finds

Blog15 Jun 2021

How to strengthen your health and safety claims defensibility

Blog11 Jun 2021

HOW TO SUCCESSFULLY INTRODUCE HYBRID WORKING

News - Business Leader11 Jun 2021

Employee retention | How to avoid shedding staff post-lockdown

Blog09 Jun 2021

JAMES TAMM: ‘FIRE AND REHIRE’ – WHAT DO EMPLOYERS NEED TO KNOW?

News - HR Review07 Jun 2021

The health and safety implications of hybrid working

Blog07 Jun 2021

Global study finds 745,000 workers killed annually by long hours

Blog07 Jun 2021

Fire and rehire latest | Government and Tribunal weigh in

Blog02 Jun 2021

Violence against retail staff | Employers’ duties during COVID-19

Blog02 Jun 2021

The HR considerations of hybrid working

Blog01 Jun 2021

The legalities of hybrid working | 6 tips for employers

Blog27 May 2021

A right to disconnect? | Finding the formula for work-life balance in 2021

Blog21 May 2021

Employment law in education | 5 important updates for schools

Blog18 May 2021

HSE inspecting further education providers in England and Wales

Blog18 May 2021

Waking up to workplace conflict | Acas report claims disputes cost employers £1,000 per employee

Blog14 May 2021

COVID-19 Live Q&A: Harnessing a Hybrid Working Model

Webinar13 May 2021

New Wellbeing Charter offers mental health support boost for school staff

Blog12 May 2021

The end of furlough | What employers need to know about ‘fire and rehire’

Blog12 May 2021

Workplace stress | What HR can do

Blog11 May 2021

Health and safety dismissals | 2 recent cases employers need to know about

Blog07 May 2021

How to avoid mistakes when conducting risk assessments

News - People Management06 May 2021

“Patchy and inadequate” | 8 high health and safety fines handed to employers recently

Blog05 May 2021

The Aurora Group - Customer Story

Customer Story - PDF

3 post-pandemic challenges for HR

Blog04 May 2021

COVID-19 Live Q&A: Safely Reopening the Care Sector

Webinar29 Apr 2021

12 tips on how to avoid common risk assessment mistakes

News - IOSH Magazine29 Apr 2021

Quarterly Breakfast Briefing for School Leaders

Webinar28 Apr 2021

Employment challenges charity CEOs face as lockdown eases

News - ACEVO27 Apr 2021

COVID-19 Live Q&A: Reopening Hospitality & Leisure

Webinar22 Apr 2021

COVID fatigue | Keeping staff engaged with your health and safety controls

Blog20 Apr 2021

The post-pandemic workplace | Is hybrid working the answer?

Blog14 Apr 2021

COVID-19 Live Q&A: Challenges Facing Charities

Webinar14 Apr 2021

Guilty until proven innocent? | Why health and safety law puts the onus on employers

Blog08 Apr 2021

The return of non-essential retail | How to safely reopen your shop

Blog08 Apr 2021

Get prepared | HSE’s priorities for 2021

Blog06 Apr 2021

Is it time for an HR audit?

Blog30 Mar 2021

COVID-19 Live Q&A: Reopening Retail

Webinar24 March 2021

COVID-19 | What financial support is available for my business?

Blog19 Mar 2021

Whistleblowing claims soar as businesses prepare for a return to work

Blog18 Mar 2021

COVID-19 Live Q&A: What Vaccination Means for Manufacturers

Webinar18 March 2021

Help, my staff want to work from home

Blog15 Mar 2021

South Pennine Academies - Customer Story

Customer Story - PDF

Lockdown exit roadmap | The implications for employers

Blog4 Mar 2021

HSE criticised for using debt collection firms to carry out COVID-19 spot checks

Blog4 Mar 2021

Employment Status and IR35 Factsheet

Factsheet03 Mar 2021

5 employment law changes you need to know about in April 2021

Blog03 Mar 2021

The Route Map out of Lockdown (Scotland)

Webinar25 Feb 2021

Chester-headquartered Ellis Whittam accelerates growth with three acquisitions

News - Press Release03 Mar 2021

Chester-headquartered WorkNest accelerates growth with three acquisitions

News - Press Release03 Mar 2021

Employment Status and Uber FAQ

Guide02 Mar 2021

COVID-19 | The latest health and safety considerations for charities

Blog01 Mar 2021

Logistics | Managing Staff and Safety Protocols

Webinar25 Feb 2021

The Roadmap out of Lockdown

Webinar24 Feb 2021

Avoiding Unfair Dismissal Claims – Everything You Need to Know

News - Business Matters23 Feb 2021

Orca - Customer Story

Customer Story - PDF

Uber loses legal battle over drivers’ self-employed status

Blog19 Feb 2021

What the Handforth Parish Council meeting taught us about virtual communication

Blog18 Feb 2021

3 ways WorkNest can support your manufacturing business in 2021

Blog18 Feb 2021

Boris Johnson urged to declare 'long Covid' an 'occupational disease'

News - Mail Online18 Feb 2021

Cost of living | Managing pay rise pressure as an employer

Blog17 Feb 2021

Beaverfit - Customer Story

Customer Story - PDF

Moving Forward in the Third Sector

Webinar16 Feb 2021

Health and safety in logistics | 5 areas of focus for 2021

Blog15 Feb 2021

3 things HR will need to succeed in 2021

Blog09 Feb 2021

Equality and diversity | Court rules ‘stale’ training not enough to defend harassment claim

Blog09 Feb 2021

Promoting a positive workplace health and safety culture, led from the top

Blog08 Feb 2021

Health and Safety in Schools | An Introduction to our Four Pillar Approach

Guide03 Feb 2021

Experts reveal 10 greatest health and safety risks facing the education sector

Blog03 Feb 2021

HSE continues its COVID inspection regime with logistics under the spotlight

Blog01 Feb 2021

Forcing a return to the office | Risks and solutions

Blog01 Feb 2021

What to do when an HSE inspector calls

News - Supply Management28 Jan 2021

Help, an employee has COVID-19 | How to handle suspected and confirmed cases

Blog27 Jan 2021

3 ways WorkNest can support your charity in 2021

Blog27 Jan 2021

12-Point Risk Assessment Checklist

Template27 Jan 2021

12 common risk assessment mistakes | Top tips for getting it right

Blog26 Jan 2021

Can clinically extremely vulnerable people go to work during lockdown? | The latest

Blog20 Jan 2021

How to manage parents affected by school closures

Blog19 Jan 2021

10 Ways to Wellbeing | An employer's guide to supporting employees through COVID-19

Blog18 Jan 2021

10 Ways to Wellbeing

Guide18 Jan 2021

7 workplace safety tips for 2021

Blog14 Jan 2021

Furlough: Rishi Sunak may have ‘no choice’ but to extend furlough past April

News - Express.co.uk13 Jan 2021

What does 'reasonably practicable' mean when it comes to health and safety?

News - People Management11 Jan 2021

COVID-19 support | 'Lockdown leave' could save working parents

News - HR Grapevine07 Jan 2021

Catalyst Choices - Customer Story

Customer Story - PDF

Poaching employees | Can competitors steal your staff?

Blog07 Jan 2021

Experts explain: An SME guide to unfair dismissal

News - Real Business06 Jan 2021

COVID-19 | Can we force employees to get the vaccine?

Blog05 Jan 2021

‘Lockdown 3.0’ | What do the latest restrictions mean for HR?

News - HR Grapevine05 Jan 2021

Health and safety in Education | 5 high fines from 2020 and focuses for 2021

Blog04 Jan 2021

How can employers tackle bogus sickness absences?

News - People Management04 Jan 2021

Amended legislation means applicants no longer need to disclose cautions or multiple convictions

Blog24 Dec 2020

Can you compel your employees to have a vaccine?

News - HR Wire21 Dec 2020

Selecting the right candidate for redundancy

Blog21 Dec 2020

Bracing for Brexit | Live Business Briefing

Webinar17 Dec 2020

Can care home staff be compelled to be vaccinated?

News - The Care Home Environment16 Dec 2020

SafetyNest H&S Software

Video

Fatal workplace injuries have dropped, but businesses need to remain vigilant

News - People Management11 Dec 2020

Health and Safety Management Systems | Employer FAQ

Blog10 Dec 2020

The return of shielding | Can clinically extremely vulnerable people go to work?

Blog07 Nov 2020

Year in review | 12 employment law updates you might have missed in 2020

Blog03 Nov 2020

Can an employee attend work if their child is sent home from school due to COVID-19?

News - HR Review02 Dec 2020

Will health and safety change after Brexit?

Blog30 Nov 2020

Research report: Legal worries and mental health concerns mount as business leaders brace for redundancies

Blog30 Nov 2020

Are redundant employees allowed paid time off for job hunting?

News - People Management25 Nov 2020

Turning a blind eye to workplace bullying | What employers can learn from the PM’s handling of Priti Patel

Blog24 Nov 2020

Tier we go again | What employers need to know about new post-lockdown rules

Blog24 Nov 2020

Tackling employee sickness absence this winter

News - The Carer19 Nov 2020

Scotland | How will a Level 4 lockdown impact employers?

Blog18 Nov 2020

Culina Group - Customer Story

Customer Story - PDF

Redundancy consultation | When and how?

Blog16 Nov 2020

The ‘cost plus’ rule | Can employers discriminate to save on cost?

Blog13 Nov 2020

Logistics | Safety, Sustainability and Managing Staff

Webinar12 Nov 2020

RIDDOR Checklist

Checklist

Time to review risk

News - P3pharmacy10 Nov 2020

Are you in a redundancy situation?

Blog10 Nov 2020

HSE injury and ill-health statistics 2020 | Some improvements but challenges remain

Blog06 Nov 2020

How should HR react to the furlough extension?

News - People Management06 Nov 2020

Lockdown Updates and the Extended Furlough Scheme

Webinar05 Nov 2020

Protecting Employees Who Visit Other Locations

Guide

Protecting employees on client sites

Blog04 Nov 2020

The importance of compassionate leadership in 2020

Blog04 Nov 2020

Can parents attend work if their child is sent home?

News - People Management03 Nov 2020

A guide to the extended furlough scheme

News - HR Wire03 Nov 2020

BIRA - Working in Partnership

Partner Story - Video

The Definitive Employer's Guide to Sickness Absence

Guide

Health & Safety Culture Survey

Brochure

COSHH Risk Assessment

Guide

Health & Safety Course Prospectus

Brochure

Ellis Whittam Acquired by Marlowe Plc

News - Press Release29 Oct 2020

WorkNest Acquired by Marlowe Plc

News - Press Release29 Oct 2020

Pure Gym - Customer Story

Customer Story - Video

Bluestone Resorts - Customer Story

Customer Story - Video

Bluestone Resorts - Customer Story

Customer Story - PDF

Choice Care - Customer Story

Customer Story - PDF

BeaverFit - Customer Story

Customer Story - Video

The Works Customer Story

Customer Story - PDF

The Works - Customer Story

Customer Story - Video

Redundancy Resource Pack

Guide

Redundancy Checklist

Checklist

The Definitive Employer's Guide to Misconduct and Disciplinary

Guide

The Definitive Employer's Guide to Settlement Agreements

Guide

The Definitive Employer's Guide to Zero Hours Contracts

Guide

The Definitive Employer's Guide to Employee Handbooks and Policies

Guide

The Definitive Employer's Guide to Flexible Working

Guide

The Definitive Employer's Guide to Employment Tribunals

Guide

The Definitive Employer's Guide to Contracts and Handbooks

Guide

The Definitive Employer's Guide to Annual Leave and Pay

Guide

Protecting Employees on Clients' Sites

Webinar22 Oct 2020

Get clear on staff restructuring and the law

News - Supply Management21 Oct 2020

COVID-19: Managing and supporting your school's staff

News - SecEd21 Oct 2020

How employers can prepare for the firebreak lockdown

News - Business News Wales21 Oct 2020

Could Germany’s fresh air approach help UK workplaces fight COVID-19?

Blog19 Oct 2020

Performance management in the virtual workplace | 3 tips for managers

Blog16 Oct 2020

Ellis Whittam recognised as leading firm by The Legal 500

News16 Oct 2020

WorkNest recognised as leading firm by The Legal 500

News16 Oct 2020

Coronavirus restrictions | How the tier system impacts work & HR

News - HR Grapevine13 Oct 2020

Employment law SOS

News - Manufacturing Management13 Oct 2020

Preparing for a second wave | What employers can do now

Blog12 Oct 2020

The Job Support Scheme | How it works (and why it might not)

Blog06 Oct 2020

Schools and self-isolation | Can parents attend work if their child is sent home due to COVID-19?

Blog02 Oct 2020

Covid employment advice service set up by Propertymark

News - Estate Agent Today

02 Oct 2020

How can companies survive COVID-19?

News - Lawyer Monthly01 Oct 2020

COVID-19 sickness and self-isolation | When do employees qualify for SSP?

Blog29 Sep 2020

How will the Job Support Scheme actually work?

News - People Management25 Sep 2020

An initial guide to the new Job Support Scheme

News - HR News25 Sep 2020

New Job Support Scheme | A statement from James Tamm

Blog24 Sep 2020

Handling redundancy: a checklist to help startups

News - Startups Magazine20 Sep 2020

Health and safety for office workers | Practical steps for employers

Blog18 Sep 2020

Workplace inspections | HSE fines government department over poor social distancing

Blog18 Sep 2020

COVID-19 Live Q&A: Moving on in Manufacturing

Webinar17 Sept 2020

Surviving on SSP | Government urged to fix “gaping hole” in regulations

Blog15 Sep 2020

Following a Fair Redundancy Process

Webinar10 Sept 2020

COVID-19 rule change | How does the six-person limit impact businesses?

Blog10 Sep 2020

Overlooking 'basic' risks | 5 recent health and safety fines NOT related to COVID-19

Blog09 Sep 2020

Safely reopening your school | 5 lessons we can learn from Europe

Blog04 Sep 2020

Managing Collective Redundancies Compliantly

Webinar03 Sept 2020

Remote redundancy | Is consultation via Zoom, email or phone legal?

Blog01 Sep 2020

Protecting pregnant employees on a return to work

Blog27 Aug 2020

Safely reopening your school | 3 pieces of advice from our Health & Safety specialists

Blog24 Aug 2020

5 HR tips | Supporting staff through redundancy

Blog21 Aug 2020

Dealing with staff absence on reopening your school

Blog19 Aug 2020

COVID-19 Live Q&A: How to Safely Reopen Your School

Webinar14 Aug 2020

The role of health and safety training and its importance during COVID-19

Blog14 Aug 2020

The contentious issue of face coverings | Are they needed in the workplace?

Blog12 Aug 2020

What you need to know about probationary periods

Blog10 Aug 2020

Don't forget the basics | 7 areas of workplace safety that must not be overlooked during COVID-19

Blog08 Aug 2020

Becoming COVID-secure | 10 tips for creating a safe workplace post-lockdown

Blog03 Aug 2020

How to fairly select employees for redundancy

Blog31 Jul 2020

Retailer's guide | Handling redundancies

blog30 Jul 2018

How to manage employees in post-travel quarantine

Blog30 Jul 2020

Medical Practices | Safety, Shielding and Managing Staff

Webinar30 July 2020

Employment Tribunal survey suggests costlier, more complex claims

Blog27 Jul 2020

The Route Map out of Lockdown | Phase 3: Advice on Safety, Shielding and Managing Staff

Webinar24 July 2020

The Latest COVID Implications Relating to Employment Law and H&S in the Charity Sector

Webinar16 July 2020

COVID-19 | Time to review your risk assessments?

Blog22 Jul 2020

HSE inspections | How to prepare your workplace for COVID-19 spot checks

Blog16 Jul 2020

HSE statistics for 2019/20 show fewest work-related fatalities on record

Blog14 Jul 2020

Supporting mental health on a return to the workplace

Blog13 Jul 2020

The end of shielding | Can I ask high-risk employees to return to work?

Blog12 Jul 2020

Symptomatic, shielding or concerned about safety | Who should be at work?

Blog03 Jul 2020

Dismissed for conduct outside of work | What employers can learn from the 'White Lives Matter' incident

Blog01 Jul 2020

Controlling COVID risk | How to safely reopen your business

Blog30 Jun 2020

How to prevent unconscious bias when recruiting

Blog24 Jun 2020

Flexible furlough guidance published | 7 key points for employers

Blog18 Jun 2020

Redundancy | Can you ask employees to INTERVIEW for their role?

Blog11 Jun 2020

Panic at the posts | How schools can address parents safety concerns

Blog08 Jun 2020

Flexible furlough | How the Job Retention Scheme will change from July

Blog03 Jun 2020

New "Test and Trace" service could leave employers without staff for 14 days

Blog29 May 2020

Furlough | Second Treasury Direction sheds light on Job Retention Scheme rules

Blog28 May 2020

Care homes | Where you stand with your staff during COVID-19

Blog18 May 2020

The end of the Job Retention Scheme | What happens once furlough ends?

Blog11 May 2020

Furlough v redundancy | Can employers make job cuts while funding is available?

Blog07 May 2020

TUC demands tough new safety measures before lockdown lifts

Blog06 May 2020

Humiliated bank worker receives largest ever disability discrimination payout

Blog01 May 2020

Sickness and Absence - Frequently Asked Questions

Blog30 Apr 2020

COVID-19 | Practising good workplace hygiene

Blog30 Apr 2020

Holidays & Annual Leave | Frequently Asked Questions

Blog30 Apr 2020

Sickness Absence | Frequently Asked Questions

Blog30 Apr 2020

Furlough | Do you need employees' consent?

Blog28 Apr 2020

Supporting employees during Ramadan

Blog27 Apr 2020

COVID-19 | Health and safety measures for Care sector leaders

Blog23 Apr 2020

Government guidance v Treasury Direction | 5 new truths about furlough

Blog21 Apr 2020

Fee for Intervention FAQ

Blog20 Apr 2020

Can you withdraw the job offer?

Blog15 Apr 2020

Furlough | 6 things confirmed in the government's updated guidance

Blog09 Apr 2020

COVID-19 school closures | Exploring employers' options

Blog07 Apr 2020

HSE, TUC and CBI issue joint statement on coronavirus

Blog07 Apr 2020

Can I refuse or cancel an employees' holiday?

Blog02 Apr 2020

COVID-19 | 2 important changes to employment law

Blog02 Apr 2020

Redundancy - FAQs

Blog01 Apr 2020

Furlough | Frequently Asked Questions

Blog01 Apr 2020

Redundancy | Frequently Asked Questions

Blog01 Apr 2020

Health and safety for homeworkers | Duties, risks and practical tips

Blog31 Mar 2020

Health and safety fines | 5 times employers fell short in March 2020

Blog30 Mar 2020

Homeworking | 5 ways to support staff from a distance

Blog26 Mar 2020

Laying off staff due to coronavirus | What employers need to know

Blog20 Mar 2020

Slips, suffocation and dangerous substances | February's top health and safety fines

Blog12 Mar 2020

Coronavirus | Statutory sick pay (SSP) FAQs

Blog11 Mar 2020

Should employers be concerned by unpaid overtime shaming?

Blog10 Mar 2020

International Women's Day | How greater gender balance enables businesses

Blog06 Mar 2020

Contracts, Handbooks & the Good Work Plan

Webinar05 Mar 2020

Why are employers losing the battle against bullying?

Blog05 Mar 2020

Coronavirus | Employment and health and safety FAQs

Blog04 Mar 2020

Working with hazardous substances | What employers need to know about COSHH

Blog03 Mar 2020

Electrical safety | A brief guide for employers

Blog28 Feb 2020

'Some other substantial reason' | Can employers dismiss over criminal activity?

Blog27 Feb 2020

3 health and safety disasters that cost employers thousands

Blog27 Feb 2020

Immigration overhaul | Details of points-based system revealed

Blog21 Feb 2020

Health & Safety Mock HSE Trial

Video20 Feb 2020

Supporting vegan employees | Practical tips and legal considerations

Blog19 Feb 2020

Emergency arrangements | Planning for fire and other major safety incidents

Blog18 Feb 2020

What to include in a Health & Safety Policy

Blog17 Feb 2020

Health and safety competent person FAQs

Blog17 Feb 2020

I quit! Are heat of the moment dismissals binding?

Blog14 Feb 2020

Employer beware | 5 gross misconduct myths that could land you in legal trouble

Blog14 Feb 2020

New year, new fines | January's top 5 health and safety penalties

Blog10 Feb 2020

Court rules disability must be established at the time of "discriminatory" acts

Blog10 Feb 2020

Health & Safety Mock Trial | How minor hazards can result in major penalties

Blog06 Feb 2020

Warehouse safety | 8 practical ways to reduce risk

Blog06 Feb 2020

EU workers after Brexit | What should employers do now?

Blog04 Feb 2020

Detached, exhausted and dreading work | Tackling the phenomenon of employee burnout

Blog03 Feb 2020

Blue tape | Has health and safety gone too far?

Blog01 Feb 2020

Managing employees | Are you approaching conflict wrong?

Blog27 Jan 2020

Fake news? | 5 common health and safety myths busted

Blog24 Jan 2020

Government confirms statutory bereavement leave for parents from April 2020

Blog23 Jan 2020

A Day in the Life of a WorkNest (formerly EW) Health & Safety Consultant

Video22 Jan 2019

SCHOOLS | 8 ways to keep your classrooms health and safety compliant

Blog22 Jan 2020

Direct discrimination | What employers need to know

Blog21 Jan 2020

Top 5 health and safety fines | December 2019

Blog19 Jan 2020

What women want | Employee told to "act gay" to sell handbags brings harassment claim

Blog17 Jan 2020

Unhappy birthday | Employee brings age discrimination claim over humiliating 50th remark

Blog16 Jan 2020

Health and safety on school trips | A guide for schools

Blog15 Jan 2020

Driving for work | Road safety charity calls on employers to take urgent action

Blog13 Jan 2020

National Minimum Wage and National Living Wage 2020 | Updated rates explained

Blog10 Jan 2020

Employee retention | How to combat the New Year recruitment crisis and hold on to staff in 2020

Blog08 Jan 2020

New Employment Bill | What does the new decade have in store for employment law?

Blog08 Jan 2020

Good Work Plan latest | Employment Law changes for your 2020 calendar

Blog07 Jan 2020

8 New Year's health and safety resolutions your business should consider

Blog06 Jan 2020

Philosophical belief discrimination? | Employee dismissed over transphobic views

Blog01 Jan 2020

Why a focus on behavioural safety may prove more effective than physical controls

Blog19 Dec 2020

All rewards and no repercussions | Is workplace favouritism legal?

Blog12 Dec 2019

Musculoskeletal disorders | What are they and how can employers prevent them?

Blog09 Dec 2019

Managing work-related stress | How employers can meet their duty of care

Blog01 Nov 2019

Workplace surveillance | Can employers use hidden cameras to obtain proof of misconduct?

Blog27 Oct 2019

Health & Safety for General Practices & Independent Pharmacies

Webinar07 Oct 2019

Justifying Discrimination

Webinar27 Sep 2019

Keeping pupils safe | Fire safety guide for schools

Blog13 Sep 2019

Health and safety induction training | What to include and 10 top tips for employers

Blog16 Aug 2019

The dangers of treating maternity-related sickness absence like other illness

Blog09 Aug 2019

Holidays & Absence

Webinar09 Aug 2019

Workplace fire safety | 8 essential to-dos for employers

Blog15 Aug 2019

Manufacturing & HSE Intervention

Webinar31 July 2019

What happens if an employee resigns during the disciplinary process?

Blog24 July 2019

How to conduct a fair and legal disciplinary procedure

Blog29 Oct 2020

How to expertly handle workplace grievances

Blog18 Jul 2019

Misconduct & Discipline

Webinar18 July 2019

Work-related stress | HSE strategy fails to secure improvements

Blog04 Jul 2019

HSE enforcement notices | What they are and how to handle them

Blog19 Jun 2019

Complying with Health and Safety Law in Education

Video17 Jun 2019

Health and Safety at Work Act 1974 | A guide for employers

Blog05 Jun 2019

How to keep health and safety interesting in the workplace

Blog22 May 2019

Why ignoring mental health is bad for business (and what you can do about it)

Blog14 May 2019

What is RIDDOR?

Blog01 May 2019

FAQ | Fire safety for employers

Blog19 Apr 2019

What does 'reasonably practicable' mean?

Blog22 Mar 2019

Stress in education | What can be done?

Blog27 Sep 2018

Stress | What can an employer do?

Blog13 Sep 2018

Managing Sickness During Flu Season

Blog12 Sep 2019

Guide to Fair and Unfair Dismissal

Video28 Aug 2018

8 Key Strategies to Avoid Redundancy

Blog24 Aug 2018

Employment Tribunals | Everything an employer needs to know

Blog18 Jun 2018

No Show to Disciplinary meetings

Blog 07 Jun 2018

Dealing with no shows to disciplinary meetings

Blog07 Jun 2018

Dealing With Short Term Absences in Manufacturing

Blog28 Mar 2018

Tackling Sickness Absences in the Care Sector

Blog19 Mar 2018

How to handle appeals of disciplinary decisions

Blog18 Feb 2018

Redundancy Pay

Blog07 Feb 2018

Putting a stop to bullying at work

BlogJan 31 2018

What to do if an Employee Withdraws a Grievance

Blog07 Nov 2017

How to Use a Settlement Agreement During the Redundancy Process

Blog 30 Oct 2017

3 Reasons for a Disciplinary Procedure

Blog13 Oct 2017

How to manage victimisation in the workplace

Blog12 Sep 2017

10 Things Employers Must Know About Grievances

Blog12 May 2017

Tackling persistent lateness

Blog24 Apr 2017

How to Identify Work Related Stress

Blog13 Apr 2017

Gross misconduct | 5 examples every employer should know

Blog11 Apr 2021

Redundancy | Giving staff paid time off to job hunt

Blog17 Mar 2017

Put a Stop to Fake Sickness Absences

Blog28 Nov 2016

Dealing with Grievances the Right Way

Blog 07 Nov 2016